Worried about potentially fraudulent transactions slipping through? We get it.

The Helcim Fraud Defender helps you assess the risk of online payments, working behind the scenes to help prevent losses for your business. Let's walk through how to get it set up and make the most of its features.

In this article

What is Helcim Fraud Defender?

Think of Helcim Fraud Defender as your smart assistant for online security. It analyzes seven key factors of every online, customer-initiated payment to give you a risk assessment.

| This assessment comes in the form of a "confidence score," ranging from 1.0 (high risk) to 10.0 (low risk). It’s a quick way to get a snapshot of potential risks associated with a transaction. |

It's important to remember that this score is an insightful estimation, not a guarantee. While it's a fantastic tool to help you make informed decisions, you'll still want to apply your own judgment when reviewing transactions, especially any that seem unusual.

.png)

Enabling Helcim Fraud Defender

Ready to put this tool to work? Activating Helcim Fraud Defender is straightforward.

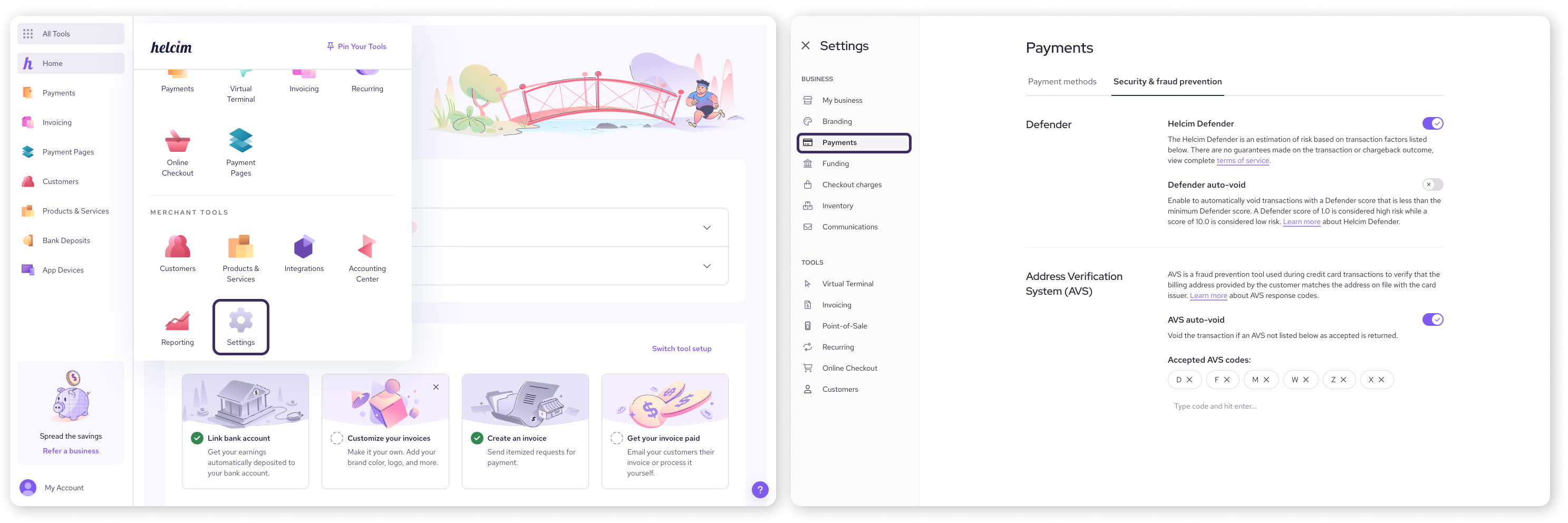

Open the All Tools menu and select Settings.

Select Payments.

Select the Security & fraud prevention tab.

Toggle the Defender Status to ON. This activates the risk assessment feature for your online transactions.

Once activated, you can configure its automatic protection settings on the same page.

AVS Auto-Void: Toggle this ON if you want the system to automatically void transactions where the Address Verification Service (AVS) response doesn't meet your criteria.

Accepted AVS codes: Select the AVS response codes you're comfortable accepting. (Need a refresher on AVS codes? Check out our guide: Decoding AVS response codes.)

Defender Auto-Void: Toggle this ON to automatically void transactions that fall below a confidence score threshold you set.

Minimum Defender Score: Set the minimum confidence score (from 1.0 to 10.0) that a transaction must achieve to avoid being automatically voided.

How to view confidence scores

You can see the confidence score for each online transaction in your transaction details.

Open the All Tools menu, and then select Payments.

Open the Transactions tab.

Select a specific online transaction to view its details.

Click on the Risk insights tab (this tab will be visible if Helcim Fraud Defender is enabled).

Within the Risk insights tab, you can click on each dropdown to see detailed information about the Fraud Defender analysis for that specific factor. This empowers you to make well-informed decisions about potentially risky transactions.

| For Helcim API users, confidence scoring is also available when the |

.png)

How is the confidence score calculated?

So, what exactly does the Helcim Fraud Defender look at to come up with a confidence score?

It analyzes these seven factors:

CVV security code: Checks if the customer correctly entered the card's 3 or 4-digit security code.

Address Verification Service (AVS): Verifies if the numeric parts of the billing address and postal/ZIP code match the cardholder's bank records.

Transaction size: Compares the current transaction amount to your average transaction size. A significantly larger transaction might be flagged.

Billing & shipping match: Checks if the billing and shipping addresses are the same. Mismatches can sometimes indicate risk.

Shipping location: Verifies if the shipping destination is in the same country as the billing address.

Bank BIN: Checks if the cardholder's issuing bank (identified by the first 6 digits of the card – the Bank Identification Number or BIN) is in the same country as the billing address.

IP address location: Verifies if the customer's IP address (their device's online location) matches the billing address location.

Next steps

Now that you understand how the Helcim Fraud Defender works, take some time to:

Review your transaction risk insights regularly.

Adjust your Helcim Defender settings to best suit your business needs and risk tolerance.

Familiarize your team with what the confidence scores mean and how to investigate suspicious transactions.

| Regularly checking your risk assessments will help you stay ahead of potential fraud. |

FAQs

Will Helcim Fraud Defender stop all fraudulent transactions?

While Helcim Fraud Defender is a powerful tool designed to significantly reduce your risk, no system can guarantee 100% fraud prevention. It's an important layer in your overall fraud management strategy, which should also include your own vigilance and best practices.

What's a "good" minimum score to set for Defender Auto-Void?

This depends on your business type, average transaction value, and risk tolerance. A lower minimum score (e.g. 3.0) is more permissive, while a higher score (e.g. 7.0) is more restrictive. We recommend starting with a moderate score and adjusting based on the alerts and your transaction reviews.

Can I override an automatic void if I think the transaction is legitimate?

Once a transaction is voided by Helcim Fraud Defender based on your settings, it cannot be un-voided. You would need to ask the customer to try the transaction again or process a new transaction if you've determined it's legitimate after further review.

Does Helcim Fraud Defender work for in-person transactions?

No, Helcim Fraud Defender is specifically designed to assess the risk of online, customer-initiated (card-not-present) transactions where it's harder to verify the cardholder's identity. For in-person transactions, be sure to follow the best practices in our blog article: 8 actionable tips to prevent card present fraud.

What does a Helcim Fraud Defender score of 0 mean for my transaction?

Think of a score of 0 as an "incomplete." It means the Fraud Defender didn't have all the pieces of information it needed from that online transaction to give a full confidence score. This doesn't automatically signal fraud! It simply means some data was missing for the analysis.

Also, it's good to know that if a transaction declines right away for other common reasons (like insufficient funds or an expired card), the Fraud Defender won't perform this risk analysis on it, so you wouldn't see a score in those cases either.