Your monthly merchant statement is your detailed report card for your payment processing activity. It shows you exactly how much you processed, what your fees were, and how much was deposited into your bank account.

Think of it as your roadmap to understanding your costs. Let's walk through how to find it and what each section means.

In this article

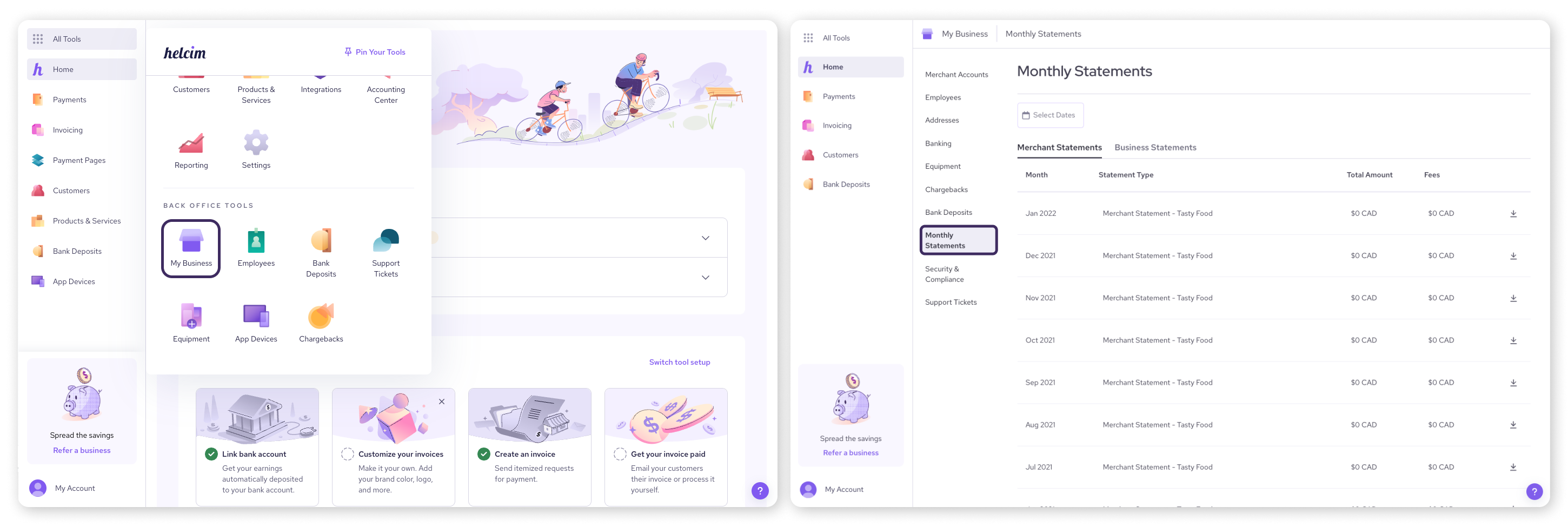

How to access your statements

Finding your monthly statements in your Helcim account is simple:

Login to your Helcim account.

Open the All Tools menu and then select My Business.

Click on Monthly Statements.

You'll see statements listed by month.

Click the Download icon next to the statement period you want to view. This will save a PDF copy to your device.

Understanding the front page summary

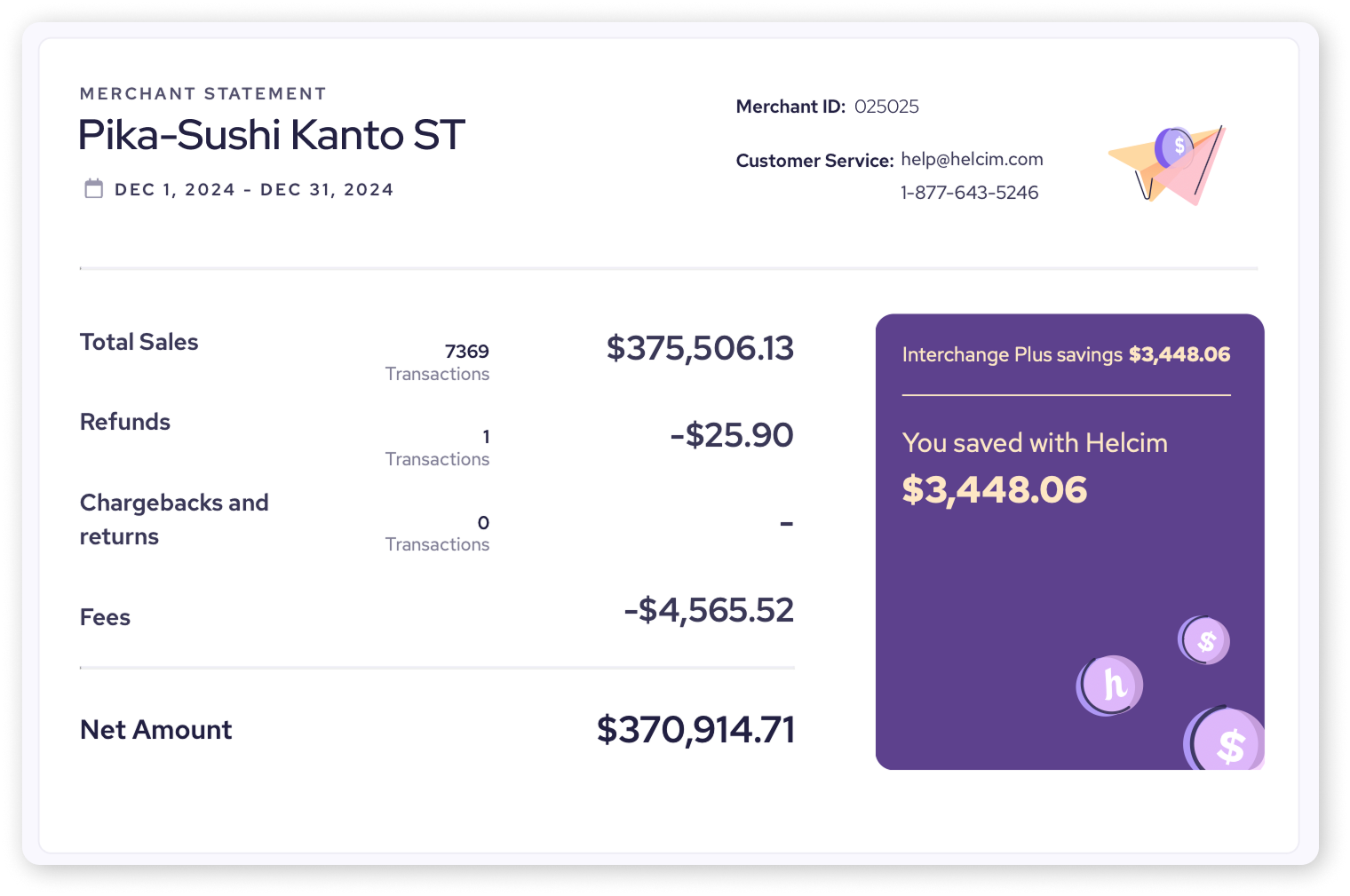

The first page of your statement gives you the big picture for the statement period.

Top Summary

This section provides your key totals:

Total Sales: The gross dollar amount and number of all your sales transactions.

Refunds: The total dollar amount and number of refunds processed.

Chargebacks and returns: The number of chargebacks received (dollar amount shown elsewhere if applicable).

Fees: The total dollar amount of all processing fees deducted during the statement period.

Net Amount: Your Total Sales minus Refunds, Chargebacks, and Fees. This is the net amount deposited to your bank over the period.

| The Interchange Plus Savings box highlights the estimated savings you achieved with Helcim's Interchange Plus pricing compared to an industry average flat-rate offered by other processors. |

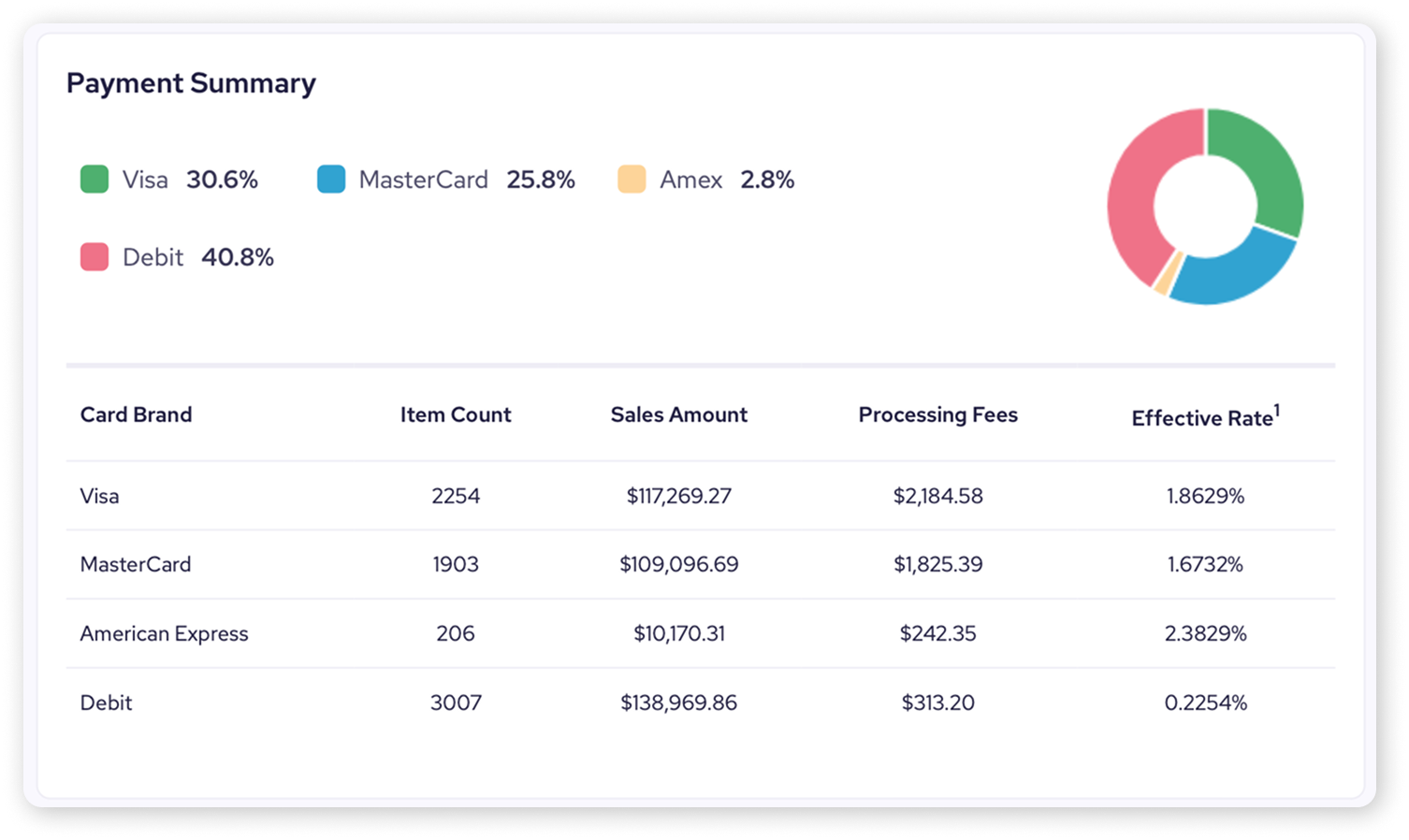

Payment Summary

This section gives you a visual breakdown (pie chart) and a table showing activity by major card brand (Visa, MasterCard, Amex, Debit):

Item Count: Number of transactions per brand.

Sales Amount: Total dollar volume processed per brand.

Processing Fees: Total fees associated with that specific brand.

Effective Rate: The actual percentage cost for processing each brand

| What is an effective rate? The effective rate is calculated by dividing Processing Fees by the Sales Amount for that card brand. It tells you a percentage of how much you’re paying in each category. |

Decoding the fee breakdown

The second page of your statement summarizes the different cost categories that make up your total fees. Further down in the statement, you'll find detailed tables breaking each of these down.

Here's what to look for.

Fee Summary (“Processing Fees” table)

This section shows the total amounts for the main fee categories.

Interchange Costs: Fees collected by the banks that issued your customers' credit cards.

Card Brand Network Costs: Fees paid directly to the card brands (Visa, Mastercard, etc.).

Helcim Card Payment Processing Costs: This is Helcim's margin – our fee for the service, software, and support.

Total Processing Fees: The sum of the three categories above.

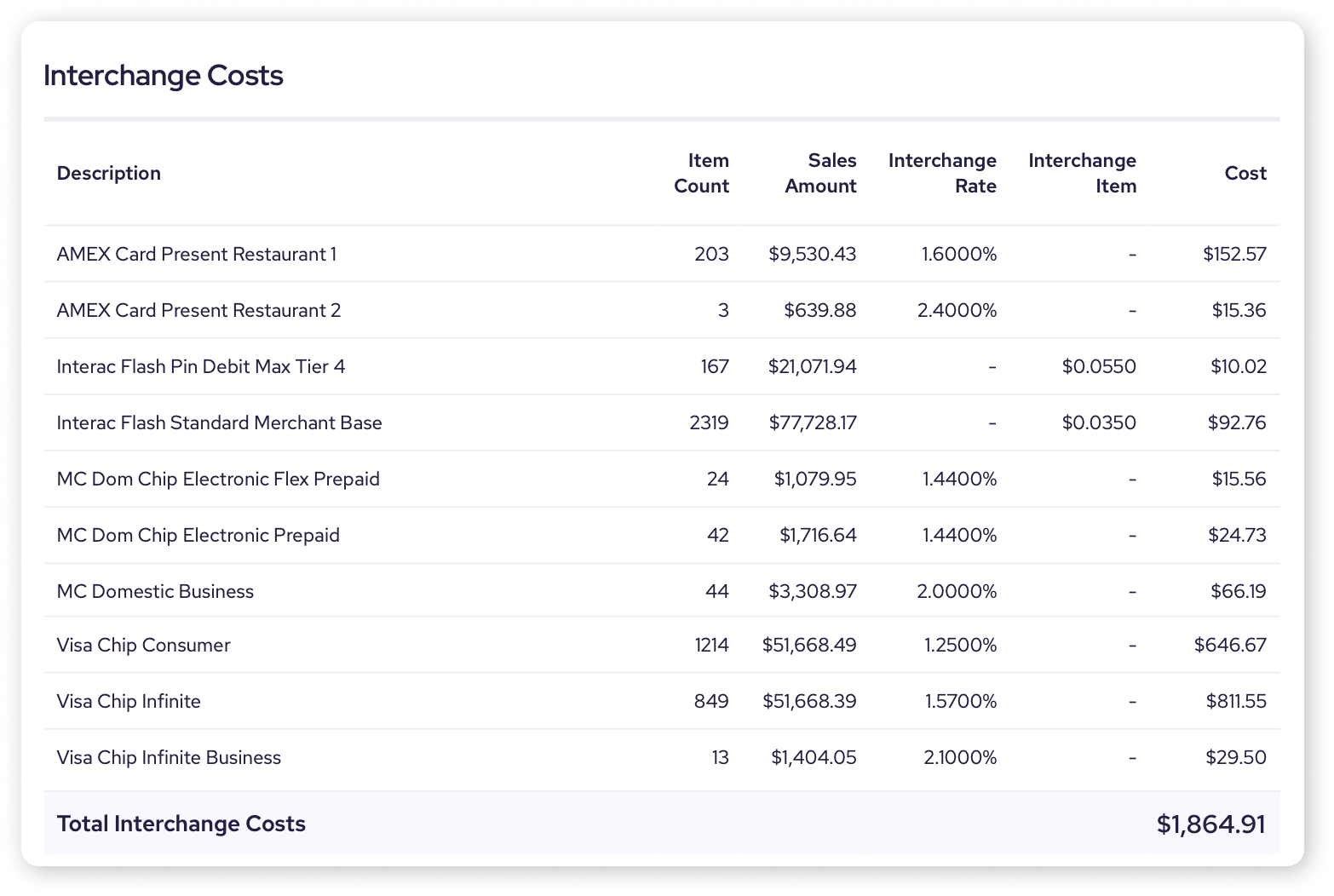

Interchange Costs

Let’s jump further down into the statement. After Card Daily Batches, you'll find an Interchange Costs table listing every single type of interchange fee incurred. This section shows:

Description: The specific name of the interchange category (e.g., "Visa Chip Consumer", "MC Dom Chip Electronic Prepaid"). This varies based on card type, how the card was processed (chip, tap, keyed), region, etc.

Item Count & Sales Amount: How many transactions and the total volume for that specific interchange category.

Interchange Rate (%) & Interchange Item (¢): The rate and/or per-item fee set by the card brands for that category.

Cost: The total interchange cost calculated for that category.

Total Interchange Costs: A sum of all the individual interchange fees.

| This section demonstrates the transparency of Interchange Plus – you see the exact costs passed through from the card brands and banks. |

Card-Brand Network Costs

This table breaks down the fees charged directly by the card brands. Examples include:

Network access fees (e.g., "AmexNetwork", "MasterCardBrand")

Cross-border assessment fees (if applicable)

Switch fees (e.g., "InteracDebitSwitchFee")

Other brand-specific fees (e.g., license fees, fixed acquirer fees)

The Total Card-Brand Network Costs is a sum of all the individual card brand fees.

| These are required fees from the card brands themselves, which Helcim passes through transparently as part of the Interchange Plus model. |

.png)

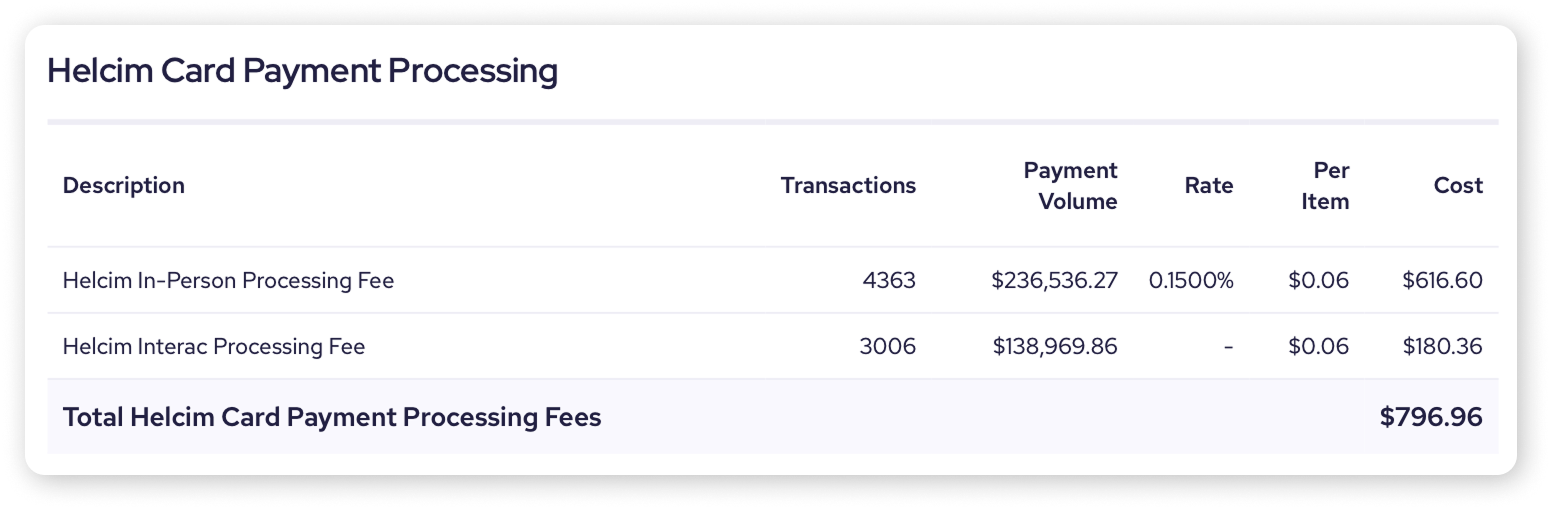

Helcim Card Payment Processing Costs

This final breakdown shows Helcim's margin applied to your transactions. It's broken down by processing method:

Helcim In-Person Processing Fee: For transactions using the Helcim Card Reader, Smart Terminal, or Tap to Pay on iPhone. Shows volume, your current tiered rate (%) and per-item fee (¢), and total cost.

Helcim Keyed & Online Processing Fee: For online processing methods, such as Virtual Terminal, Invoice, Online Store, or other transactions where a card is not physically present.

Helcim Interac Processing Fee: For Canadian Interac Debit transactions, typically just a per-item fee.

Total Helcim Card Payment Processing Fees: A sum of the margins Helcim charges.

| This shows Helcim's margin for our service. Remember, this rate can automatically decrease as your processing volume grows, thanks to our automatic volume discounts! |

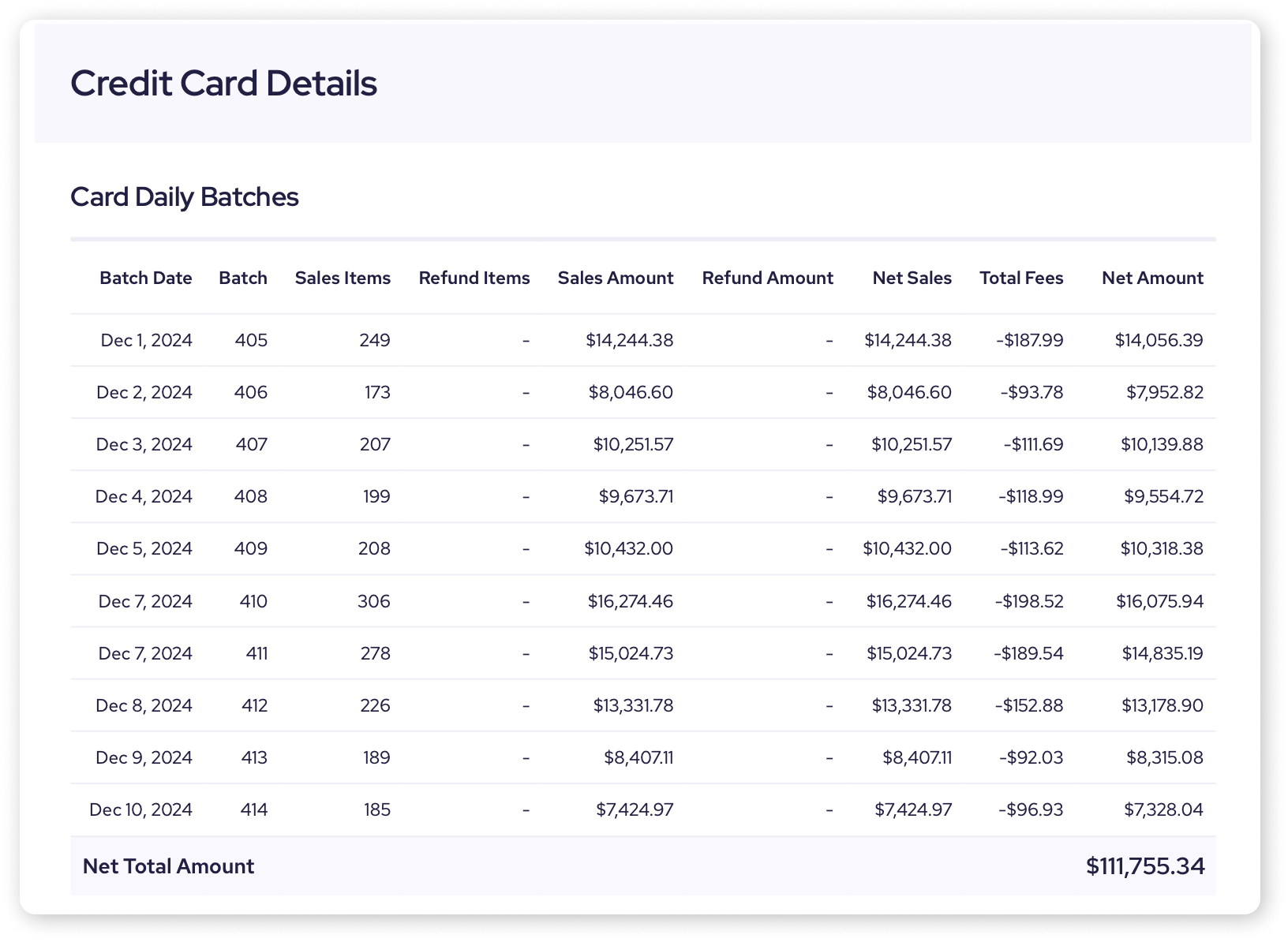

Reviewing card daily batches

Go back up to the top of the third page, and you'll find a chronological list of every batch settled during the statement period. Each line represents a batch (often one day's worth of transactions) and shows:

Batch Date & Batch #: When the batch was processed and its unique ID.

Sales Items & Refund Items: Number of sales and refunds included in that batch.

Sales Amount & Refund Amount: Total dollar value of sales and refunds in the batch.

Net Sales: The Sales Amount minus Refund Amount for the batch.

Total Fees: The processing fees calculated for that specific batch.

Net Amount: The final amount deposited (or to be deposited) for that batch (Net Sales minus Total Fees).

| If you are on net deposits, the Net Amount will be what is deposited into your linked bank account. If you are on gross deposits the Net Sales will be what is deposited, and then the Total Fees will be withdrawn in a separate transaction. Learn more about net and gross deposits here. |

Other statement sections

Depending on your activity, you might also see these additional sections on your monthly statement.

ACH Payment Details

If you use Helcim for ACH bank payments, details would be listed here.

.png)

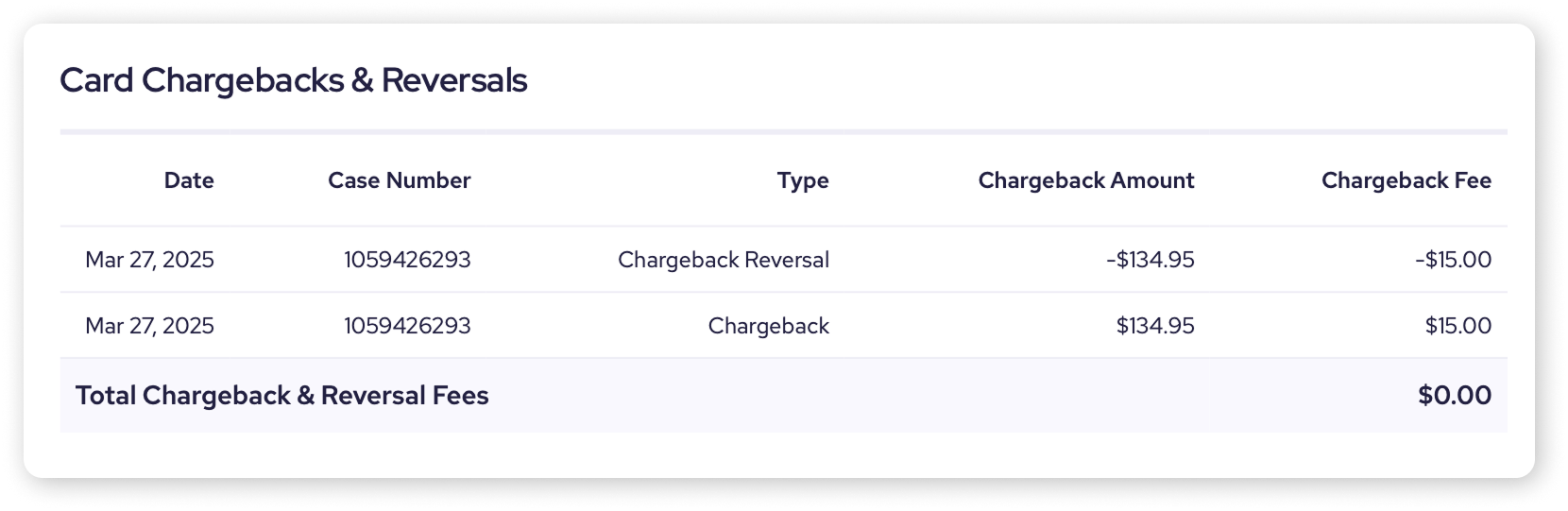

Card Chargebacks and Reversals

Details any chargebacks initiated during the period.

Next steps

Now that you know how to navigate your monthly statement, you're well on your way to fully understanding your processing costs! Want to learn more? Here are some helpful resources:

Save on fees: Find out how Level 2/3 interchange optimization or volume discounts can help you save on fees.

Understand pricing basics: Dive deeper into how Interchange Plus works with our foundational pricing articles.

See our rates: Visit the Helcim Pricing Page on our website for a full overview of our rates and volume discounts.

Learn about deposits: Understand how your daily transactions turn into bank deposits in our series on Batches and Settlements.

FAQs

Where do I find my monthly statement in my Helcim account?

Log in, go to My Business, then Monthly Statements. Make sure Merchant Statements is selected and click the Download icon.

Where can I see my current processing rate from Helcim?

Look in the "Helcim Card Payment Processing" section of the fee breakdown. It shows the percentage and per-item fee applied based on transaction type (in-person vs. keyed/online).

Why are 'Business Statements' unavailable?

We discontinued providing separate 'Business Statements' in July 2022. All necessary payment processing information is now consolidated in your 'Merchant Statement'.

I still don't understand a part of my statement. What should I do?

We're here to help! Please reach out to our support team. They'd be happy to walk you through any section you have questions about and make sure it's crystal clear.

Why are there so many different interchange rates listed?

That's a great question! Interchange rates are set by the card brands (Visa, Mastercard) and issuing banks, and they create many different categories based on factors like:

The type of card used (rewards, corporate, debit)

How it was entered (tap, chip, keyed)

The business type, and more.

While seeing all these rates might seem complex, Interchange Plus pricing shows you these exact costs transparently. This ensures you only pay the true cost plus Helcim's small margin, which typically saves you money compared to bundled or tiered rates where these details are hidden.

| For a refresher, see: What am I paying fees for? |