To meet our regulatory obligations, Helcim is required to collect information about the Ultimate Beneficial Owners (UBOs) of the businesses we serve.

Helcim provides a simple way for you to submit this information from within your Helcim account. This article will help you understand what UBOs are, and how to complete the form for UBO compliance.

In this article

What is UBO compliance?

UBO stands for Ultimate Beneficial Ownership. It refers to the individuals who ultimately own or control your business. To comply with anti-money laundering and anti-terrorist financing laws and regulations, Helcim needs to know who these individuals are.

Why is UBO compliance important for your business?

Here are a few key reasons why providing UBO details can directly benefit your business and others:

It keeps your account running smoothly. Helcim is legally required to collect UBO information to help prevent financial crimes. Submitting these details ensures your payment processing services can continue without interruption.

You're helping create a safer economy. Your cooperation contributes to a more transparent financial system, which protects all legitimate businesses (including yours!) from illicit activities.

It's a standard requirement. This isn't just a Helcim rule, it's a common obligation for businesses using financial services everywhere. We've focused on making the submission process in your Helcim account as simple as possible.

In short, keeping your UBO information complete and up-to-date is a necessary step for uninterrupted service and contributes to a more secure business environment for everyone.

Who are UBOs?

UBOs are individuals who directly or indirectly own or control 25% or more of your business. They must be actual people, not another company or entity.

| Direct ownership means you directly own a share of the business, while indirect ownership means you own a share through another entity, such as a holding company. |

What information do we need?

When completing the UBO Compliance form, you will need to provide information about the people who own or control your business. This includes:

Ultimate beneficial owners (UBOs): If someone directly or indirectly owns 25% or more of your business, you'll need to provide their information.

People with significant control: If no one owns 25% or more, you'll need to provide information about the people who have significant control over your business, like a CEO or President.

Information needed: For each person, you’ll need to provide their full name, their address, and whether they are an owner or have significant control. If they are a UBO, you'll also need to provide their percentage of ownership.

Directors (if applicable): If your business is a corporation or non-profit, you’ll also need to provide the full names of your directors.

How to complete your UBO compliance

Go to All Tools and then My Business.

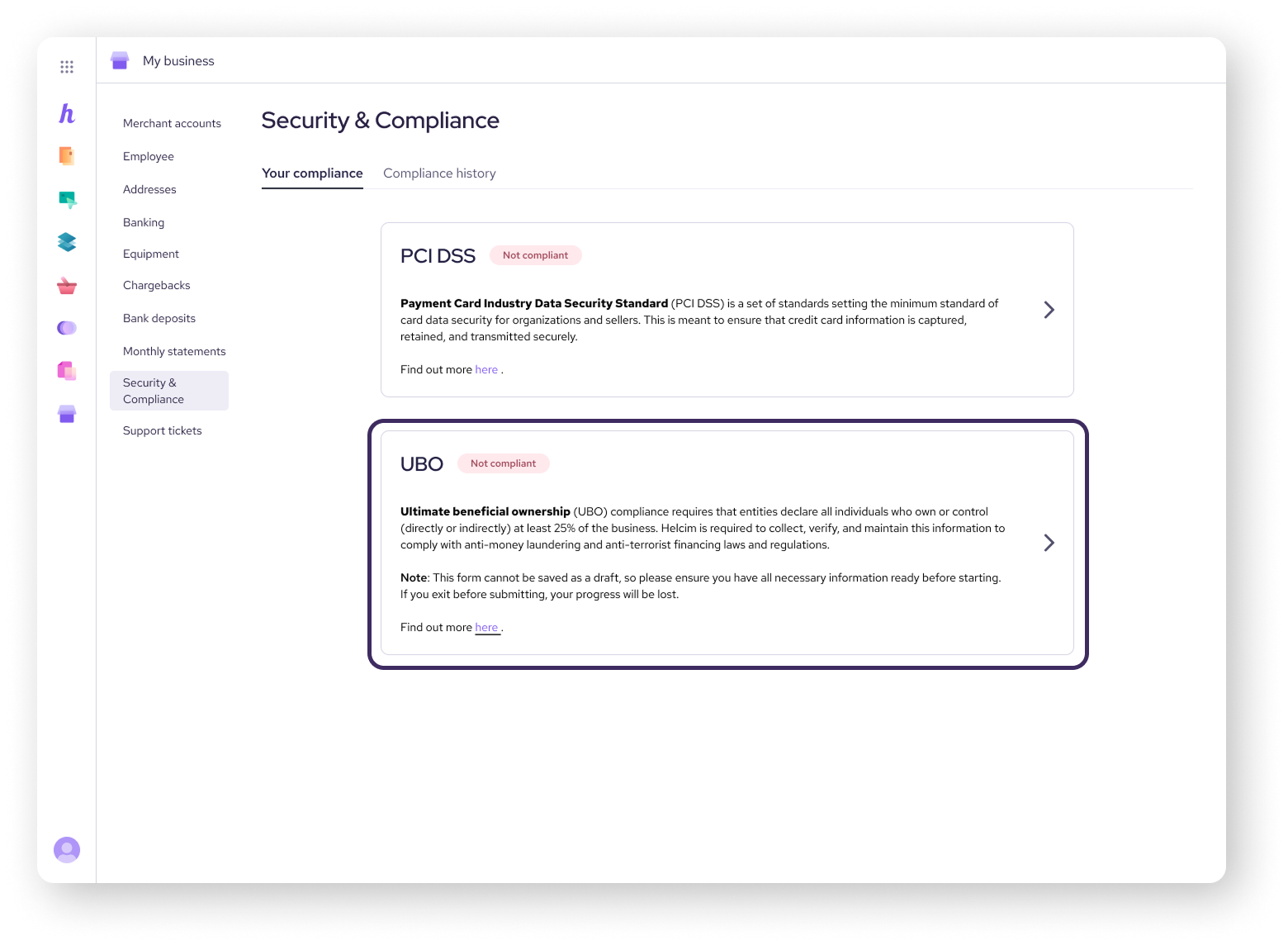

Click on Security & Compliance.

Click on the UBO tile

Answer the provided questions.

Click on Submit Compliance.

Updating or confirming your information

Each year you will be required to update your UBO information.

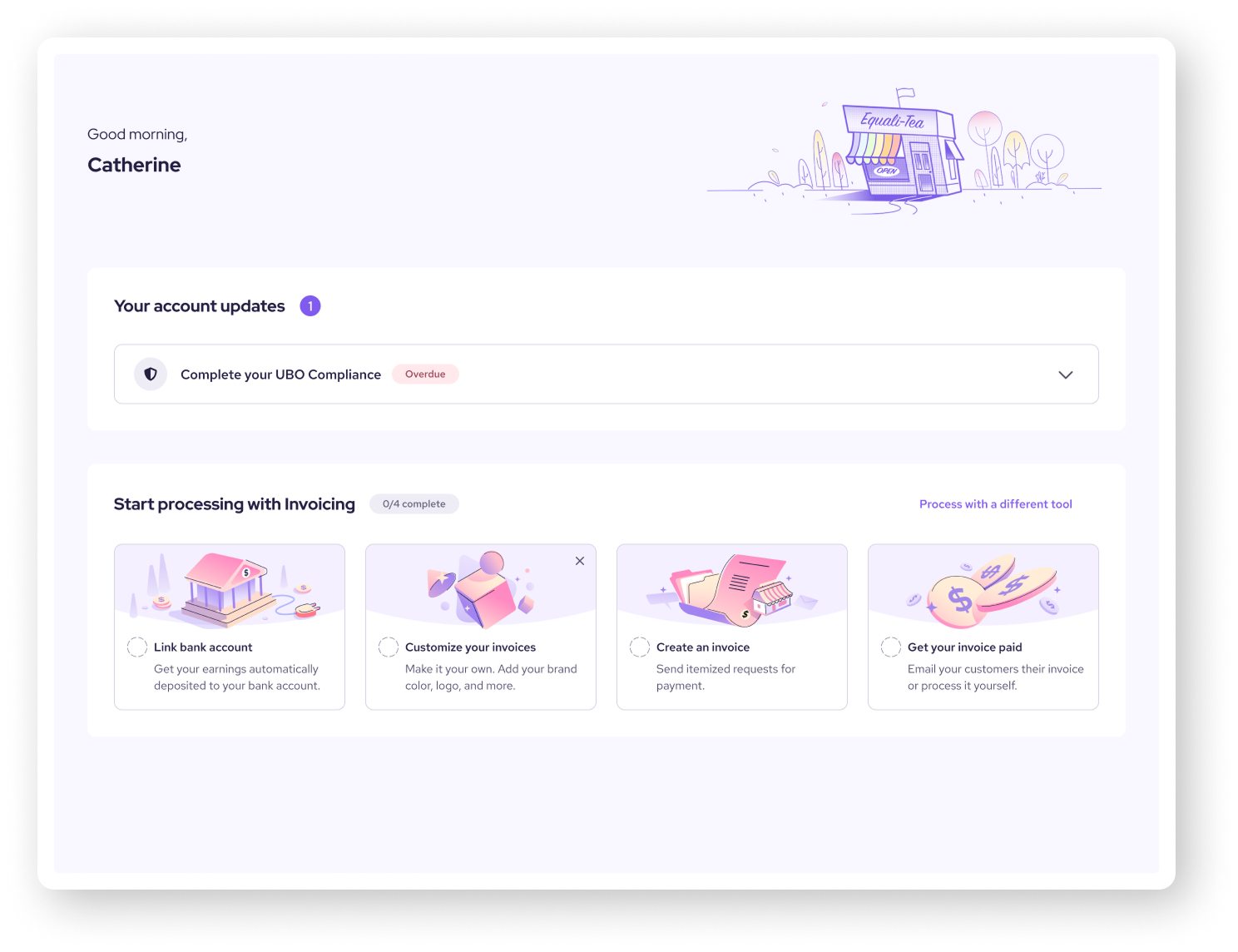

| When the time comes, you’ll see a “Complete your UBO Compliance” message on your account dashboard. |

To complete the updates, follow these steps:

Go to All Tools and then My Business.

Click on Security & Compliance.

Click on the UBO tile.

If you are due for updates, you should see a tile that says “not compliant”.

Select the Edit button and enter any information that has changed.

Review the information and click the checkbox to confirm that it is accurate.

Once you are done making updates, click on Renew.