Getting the best possible payment processing rate shouldn't require constant negotiation.

This article explores two key ways Helcim helps you save automatically: volume discounts that lower your rate as you process more, and interchange optimization by providing Level 2 and Level 3 data to Visa and Mastercard.

In this article

Saving with automatic volume discounts

As your business grows, your processing costs with Helcim can automatically decrease! We offer volume-based discounts on our Helcim margin (the '+' part of Interchange Plus).

Here’s how it works:

Based on Volume: Your rate tier is determined by your average monthly credit card processing volume over the last three months.

Automatic Adjustments: We automatically calculate this average and adjust your rate tier accordingly. If your volume increases into a new tier, your rate drops automatically – no need to call in or sign anything.

Stability: Using a three-month average prevents your rate from jumping around due to short-term fluctuations in sales.

Here are the volume tiers for our processor margin on In-Person transactions (tap, chip, swipe).

Monthly credit card volume | Discount tier | In-person rate (Helcim margin) |

$0 - $50K | 1 | Interchange + 0.40% + 8¢ |

$50K - $100K | 2 | Interchange + 0.35% + 7¢ |

$100K - $500K | 3 | Interchange + 0.25% + 7¢ |

$500K - $1M | 4 | Interchange + 0.20% + 6¢ |

$1M + | 5 | Interchange + 0.15% + 6¢ |

Here are the volume tiers on Keyed & Online transactions (manual entry or using our online payment tools).

Monthly credit card volume | Discount tier | Keyed & online rate (Helcim margin) |

$0 - $50K | 1 | Interchange + 0.50% + 25¢ |

$50K - $100K | 2 | Interchange + 0.45% + 20¢ |

$100K - $500K | 3 | Interchange + 0.35% + 20¢ |

$500K - $1M | 4 | Interchange + 0.25% + 15¢ |

$1M + | 5 | Interchange + 0.15% + 15¢ |

| You can find interactive versions of these tables on our pricing page. |

Saving with Level 2 and Level 3 interchange optimization

If you process transactions from other businesses (B2B) or government agencies (B2G), Helcim works automatically to qualify these transactions for lower interchange rates set by Visa and Mastercard.

This is done by submitting extra information about the transaction, known as Level 2 (L2) and Level 3 (L3) data.

| This behind-the-scenes optimization is a key benefit for B2B merchants, helping reduce interchange costs automatically. |

What is Level 2/3 data?

It's additional information beyond the basic transaction details (Level 1).

Level 2 Data includes things like tax amount, customer code, and your business tax ID.

Level 3 Data includes even more detail, like line-item specifics (SKUs, quantity, unit of measure), shipping information (postal codes), and invoice numbers.

Where is Level 2/3 data sent?

When you process a payment, any extra Level 2 or Level 3 details are packaged with the basic transaction information.

Helcim sends this complete package to the card networks (like Visa or Mastercard).

The card networks then pass it along to your customer's card-issuing bank.

Once the details reach the card networks and the customer's bank, they recognize the transaction as lower risk and apply better interchange rates.

Why does it lower costs?

When Visa and Mastercard receive this extra data, they view the transaction as less risky and more detailed, qualifying it for lower interchange rates. These savings can be significant, potentially ranging from 0.5% to 1.5% or more on the transaction amount, especially on large B2B purchases.

How Helcim automates it

The best part? Helcim automatically gathers and submits available L2 and L3 data for you whenever possible!

If you use Helcim's tools like Invoicing or store customer profiles and product details, our system pulls the necessary information (like tax amounts, customer codes, line items) and includes it with the transaction sent to the card brands.

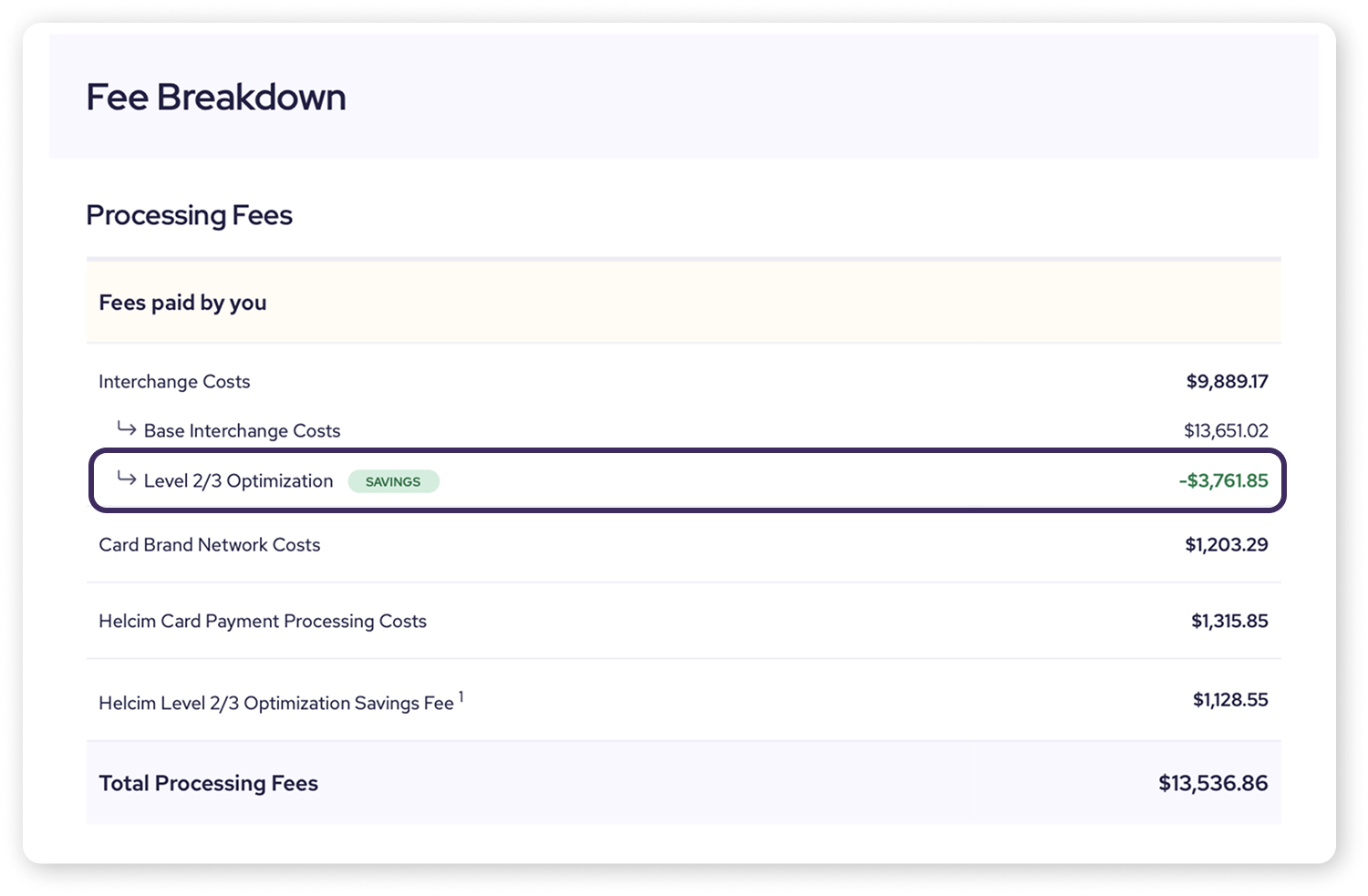

| For providing this service, we retain a 30% optimization fee on the savings generated by the lower interchange rates. You’ll see exactly how much you saved and how much is retained in the Fee Breakdown on your monthly statements. |

Which cards qualify?

These lower rates generally apply when your customer pays with a corporate, purchasing, or government card. Standard business credit cards often don't qualify for L3 rates, but may qualify for L2. Sending L3 data for a card only eligible for L2 doesn't negatively impact the transaction.

See Level 2/3 savings and fees on your statement

Your monthly statement will show your savings from Level 2/3 optimization, as well as the 30% optimization fee, under the Fee Breakdown section.

Next steps

See your rate and savings: learn how to view your monthly statements to see your current rates and look for any Level 2/3 optimization savings.

Learn more about Level 2/3 savings: Read our Merchant Guide on Level 2 and Level 3 processing for more details on what credit card data is needed, as well as average savings per industry using Level 2/3 optimization.

FAQs

Do I need to apply for volume discounts?

No! Volume discounts are applied automatically based on your three-month rolling average processing volume.

How often does my rate get reviewed for volume discounts?

Helcim systems automatically review your volume average regularly to ensure you're always in the correct rate tier.

Do I need to manually enter Level 2 or Level 3 data?

No, Helcim's system automatically retrieves and optimizes this data from information already in your account (like customer details, tax settings, invoice line items) when processing transactions. Using features like Helcim Invoicing helps ensure this data is available.

Which transactions get lower interchange rates with L2/L3 data?

Transactions paid with eligible corporate, purchasing, or government cards can qualify for L2 or L3 rates when the required data is submitted. Standard consumer or small business cards typically don't qualify.

Does sending Level 3 data increase costs if the card doesn't qualify?

No, providing Level 3 data does not negatively affect processing costs if the customer's card only qualifies for Level 1 or Level 2 rates.