Chargebacks can be a stressful part of running a business. When a customer disputes a transaction with their credit card company, it can lead to lost revenue and added fees.

But understanding what chargebacks are and how they work can help you navigate these situations more effectively. This article will cover the basics of chargebacks, including what they are, why they happen, and what Helcim's role is in the process.

In this article

What are chargebacks?

A chargeback is when a customer's bank reverses a credit card transaction because the customer doesn't agree with it. This can be for the full amount or a partial amount of the transaction.

| Think of it like this: if a customer pays with cash and isn't happy with their purchase, they'd usually have to go back to the store to ask for a refund. A chargeback is a similar process, but it's handled by the customer's bank. |

Chargebacks are often used to protect consumers from things like fraud, defective products, or billing errors.

Reasons for chargebacks

There are many reasons why a customer might file a chargeback. Here are some of the most common:

Fraud: The customer didn't make the purchase, and their card was used without their permission.

Errors: There was a mistake in the billing, such as a duplicate charge or the wrong amount being charged.

Product issues: The customer didn't receive the product, it was damaged, or it wasn't what they expected.

While it's always best for a customer to contact the merchant directly to resolve an issue, sometimes they go straight to their bank.

They might choose this route if:

They've already tried to contact the merchant but haven't received a response.

They're not satisfied with the merchant's response.

They find it easier to deal with their bank.

They want an extra layer of protection.

The chargeback life cycle

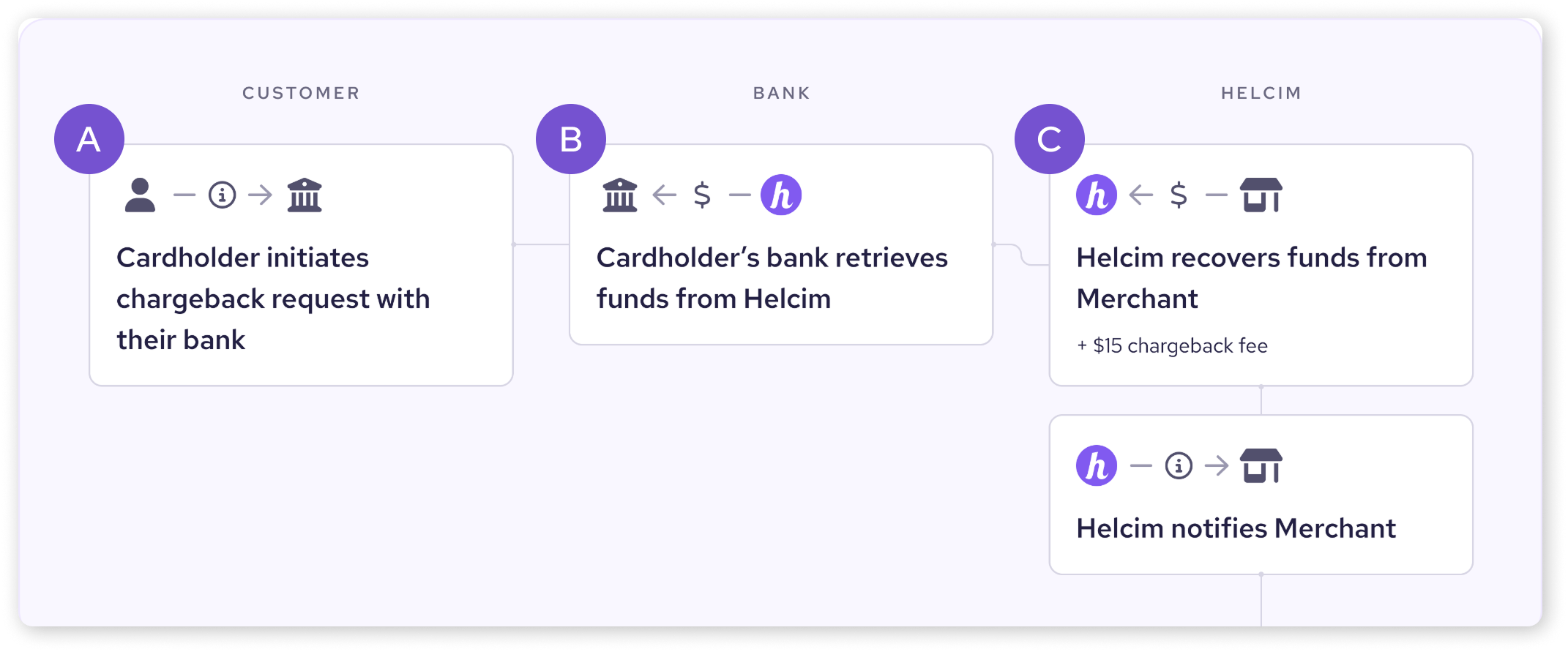

When a chargeback is filed, it follows a general process, as illustrated below.

A. Customer initiates chargeback

The customer contacts their bank to dispute the charge.

B. Bank's actions

The customer's bank temporarily retrieves the disputed funds from Helcim.

C. Helcim's actions

Helcim debits the disputed amount, plus a $15 chargeback fee, from your account.

Helcim notifies you of the chargeback.

| Note: if your business ends up winning the chargeback, you’ll be refunded the $15 chargeback fee. |

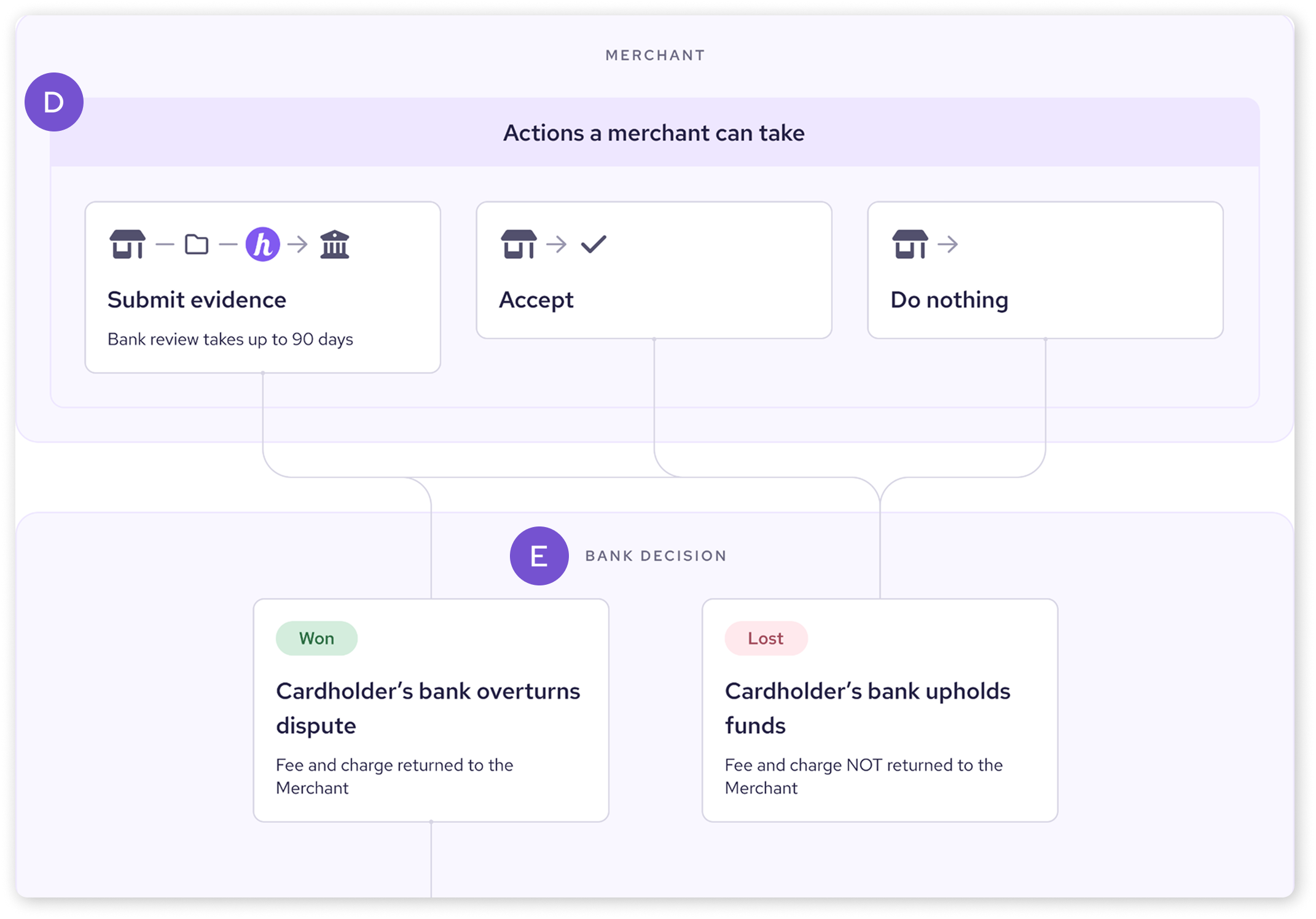

D. Merchant actions

You have several options:

Submit evidence: Dispute the chargeback by providing supporting documentation.

Accept: Concede the chargeback. Learn more about the consequences here.

Do nothing: The chargeback will be processed as an acceptance.

E. Bank decision

The cardholder's bank reviews the evidence (if submitted) and makes a decision:

Cardholder's bank overturns dispute (Win): You receive the funds back.

Cardholder's bank upholds funds (Loss): The customer keeps the funds.

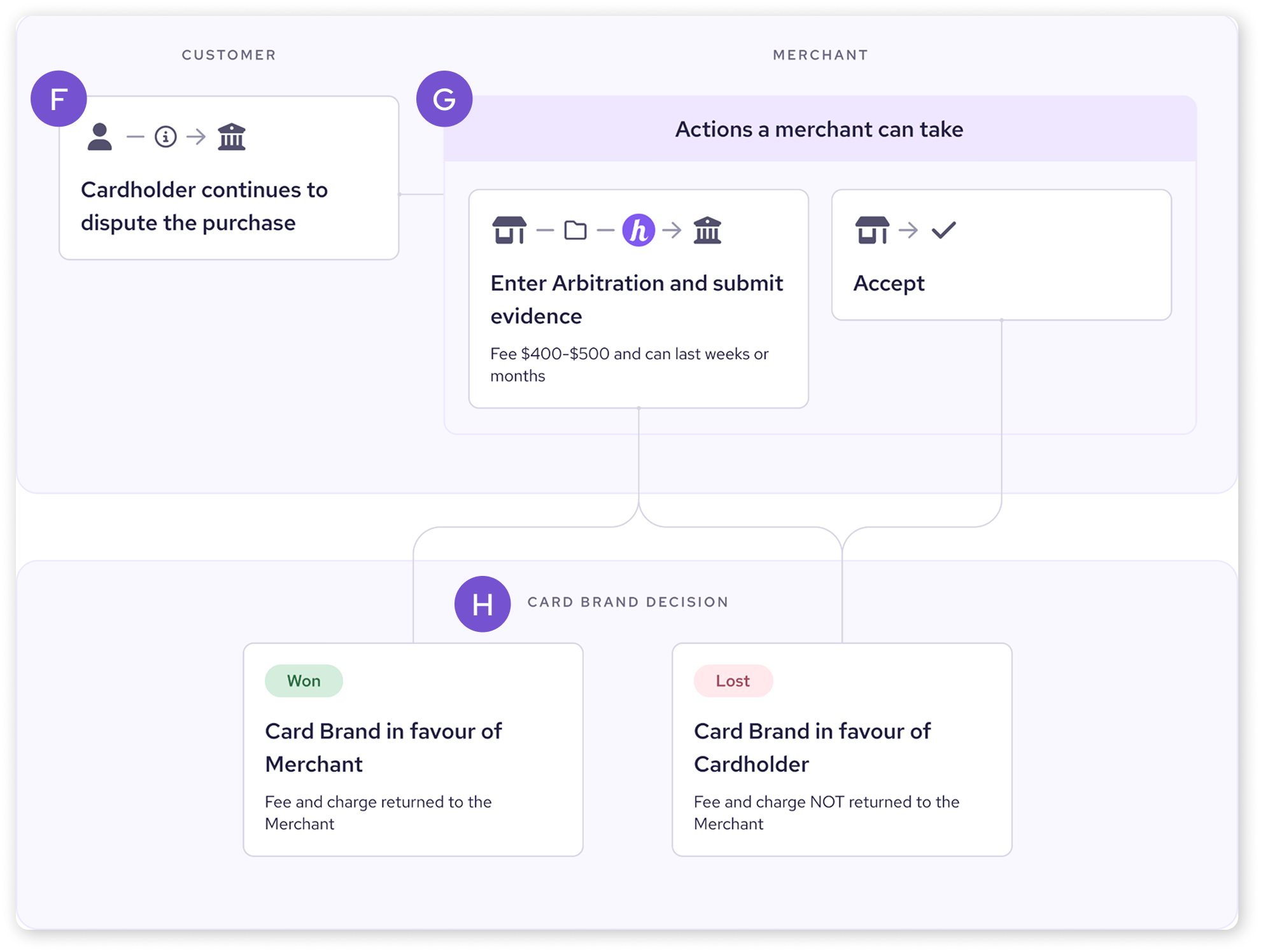

F. Customer continues to dispute

In some cases, the customer can choose to further dispute the decision.

G. Enter arbitration (Merchant option)

You can choose to enter arbitration.

This involves providing an arbitration document that summarizes all previously submitted evidence.

Be aware that arbitration can involve significant fees.

H. Card brand decision

The card brand (e.g., Visa, Mastercard) makes a final decision:

Card brand in favor of Merchant (Win): You receive the funds.

Card brand in favor of Cardholder (Loss): The customer keeps the funds.

Helcim's role in the chargeback process

Helcim plays an important role in the chargeback process. Here's what we do:

Notify you: We'll let you know about the chargeback through our platform, email, or a call from our Trust & Safety team.

Debit/Credit: We'll temporarily debit the disputed amount (plus a $15 chargeback fee per transaction) from your account. If you win the dispute, this amount and fee will be credited back to you.

Guide you: We'll provide information on the reason for the chargeback and guide you through the steps to respond in the Chargebacks section of your Helcim platform.

Support you: We'll offer advice on how to best counter the dispute.

It's important to remember that Helcim doesn't make the final decision in a chargeback case—that's up to the customer's bank. But we're here to help you through the process.

What happens if you accept a chargeback?

While accepting a chargeback is sometimes the appropriate course of action, it's important to understand the potential consequences for your business.

Financial loss

You will lose the disputed transaction amount. This means you won't be paid for the product or service, even if it has already been provided to the customer.

Chargeback fee

Helcim charges a $15 fee for each chargeback you accept. This fee helps cover the administrative costs associated with processing the dispute.

Potential impacts on your merchant account

A high number of chargebacks can increase the perceived risk associated with your merchant account. This could lead to:

Delayed availability of funds.

Increased scrutiny of transactions.

In severe cases, the potential for account closure.

The upsides of taking action on a Chargeback

Because of the consequences of chargebacks, there are significant benefits to actively managing them.

Recovering revenue

By successfully countering a chargeback, you can retain the revenue from the transaction. This is especially important if you've already provided the goods or services.

Protecting your account

Proactively countering chargebacks and implementing prevention strategies can help you maintain a healthy merchant account and avoid potential penalties.

Building customer trust

By addressing disputes fairly and transparently, you can demonstrate your commitment to your customers and strengthen your relationships with them.

Next steps

To learn how to manage chargebacks directly within your Helcim dashboard, check out our article on Viewing and responding to chargebacks.

To learn how to effectively counter chargebacks, see our guide: Tips on countering chargebacks.

For tips on preventing chargebacks, check out our article: Preventing Chargebacks.

FAQs

What is the difference between a refund and a chargeback?

What is the difference between a refund and a chargeback?

How does a chargeback affect my business?

Chargebacks can result in lost revenue, fees, and potentially damage your reputation with payment processors. It's important to take them seriously and try to prevent them whenever possible.

Who makes the final decision in a chargeback case?

The final decision is made by the customer's bank, not Helcim. However, we are here to provide guidance and support throughout the entire process.

We'll help you understand the reason for the chargeback, gather evidence, and present your case effectively. While we can't guarantee a specific outcome, we're committed to helping you get the best possible shot at a fair resolution.