Failed payments are an unfortunate reality for any business that uses recurring billing.

Helcim provides tools to help you recover those payments and minimize disruptions to your revenue stream. This article will guide you through how to manage failed payments within Helcim Recurring.

In this article

Understanding failed recurring payments

A failed payment means that a scheduled recurring payment could not be processed. There are various reasons why this might happen, including:

Insufficient funds

Expired credit card

Incorrect payment details

Bank issues

It's crucial to address failed payments promptly to avoid losing revenue and potentially disrupting service for your customers.

Notifications for recurring payments

Using Helcim’s automated email notifications can help prevent failed recurring payments.

The following email notifications are relevant:

Transaction declined

Billing heads-up

Card expiring notice

Request new payment information

| For more information on managing the email communications sent to your customers when payments fail, refer to Managing customer communications. |

Retrying failed recurring payments

Helcim provides automatic retries for failed recurring payments.

To enable:

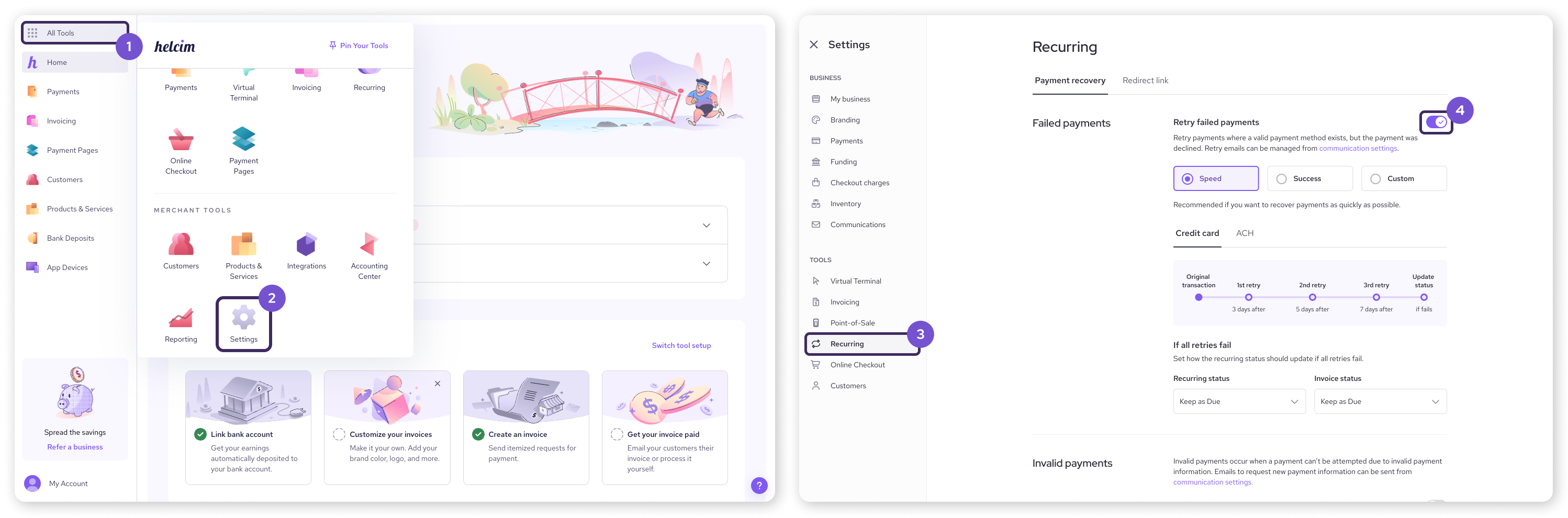

Open the All Tools menu

Select Settings.

Select Recurring from the left-side menu

Click the toggle next to Retry failed payments.

You can choose from the following automatic retry schedule.

Speed

Credit cards: Retries at 3, 5, and 7 days after the due date.

ACH: Retries at 7 days after the due date.

Success

Credit cards: Retries at 7, 14, and 21 days after the due date.

ACH: Retries at 14 days after the due date.

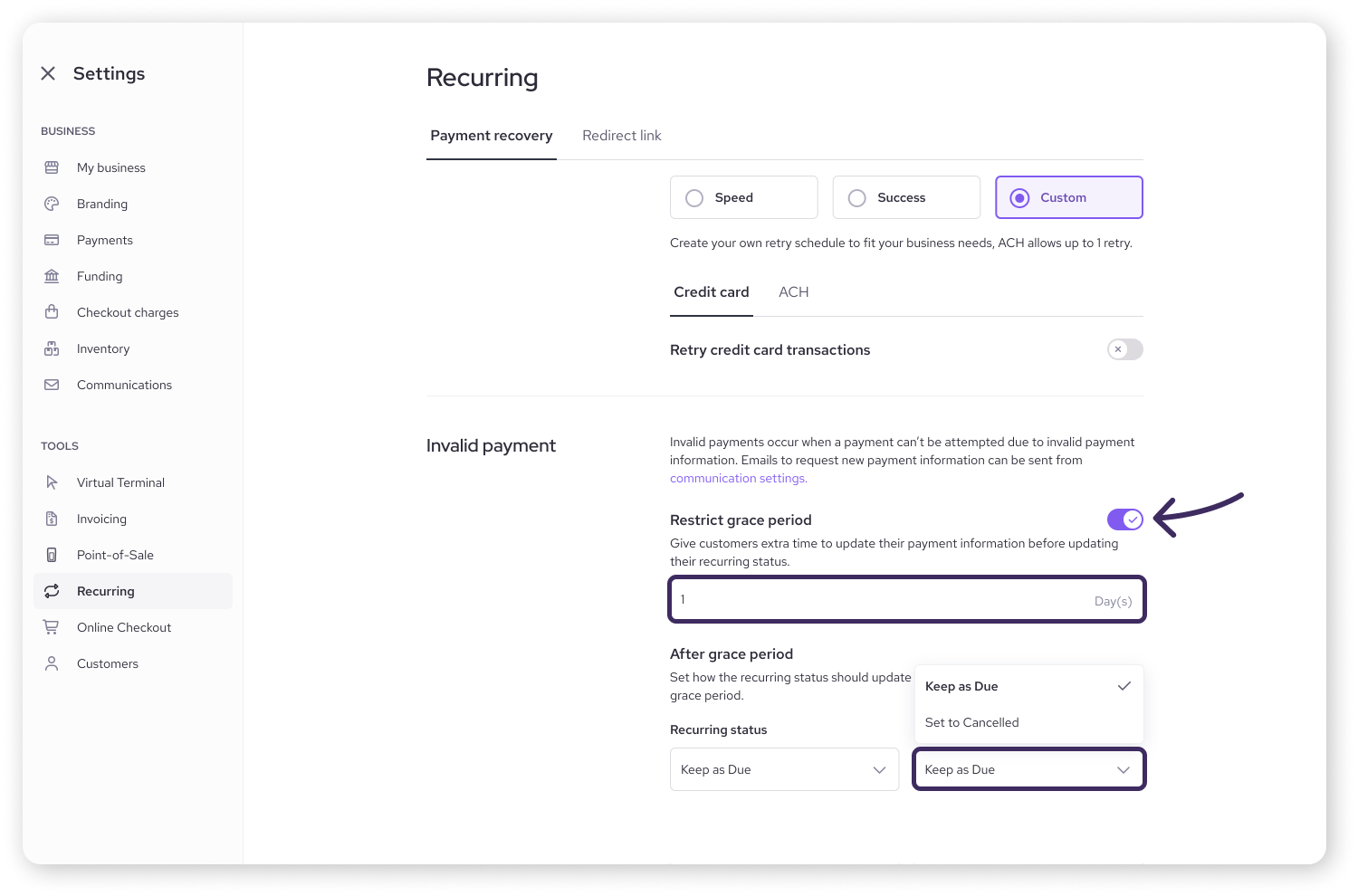

Custom

Set your own retry intervals for both Credit Card and ACH.

Click the toggle next to Retry credit card transactions

Click Edit next to Retry schedule

Enter the number of days for the 1st retry in the box

For credit card only: select Add retry to add additional retries

Click Save

| You can only retry ACH payments once. |

| ACH plans are only retried if the failure was due to insufficient funds. Other issues will not trigger retries. |

Updating statuses after failed payments

You may the status of your recurring customer, or their invoice, to change if a payment fails.

There are two scenarios you can use here.

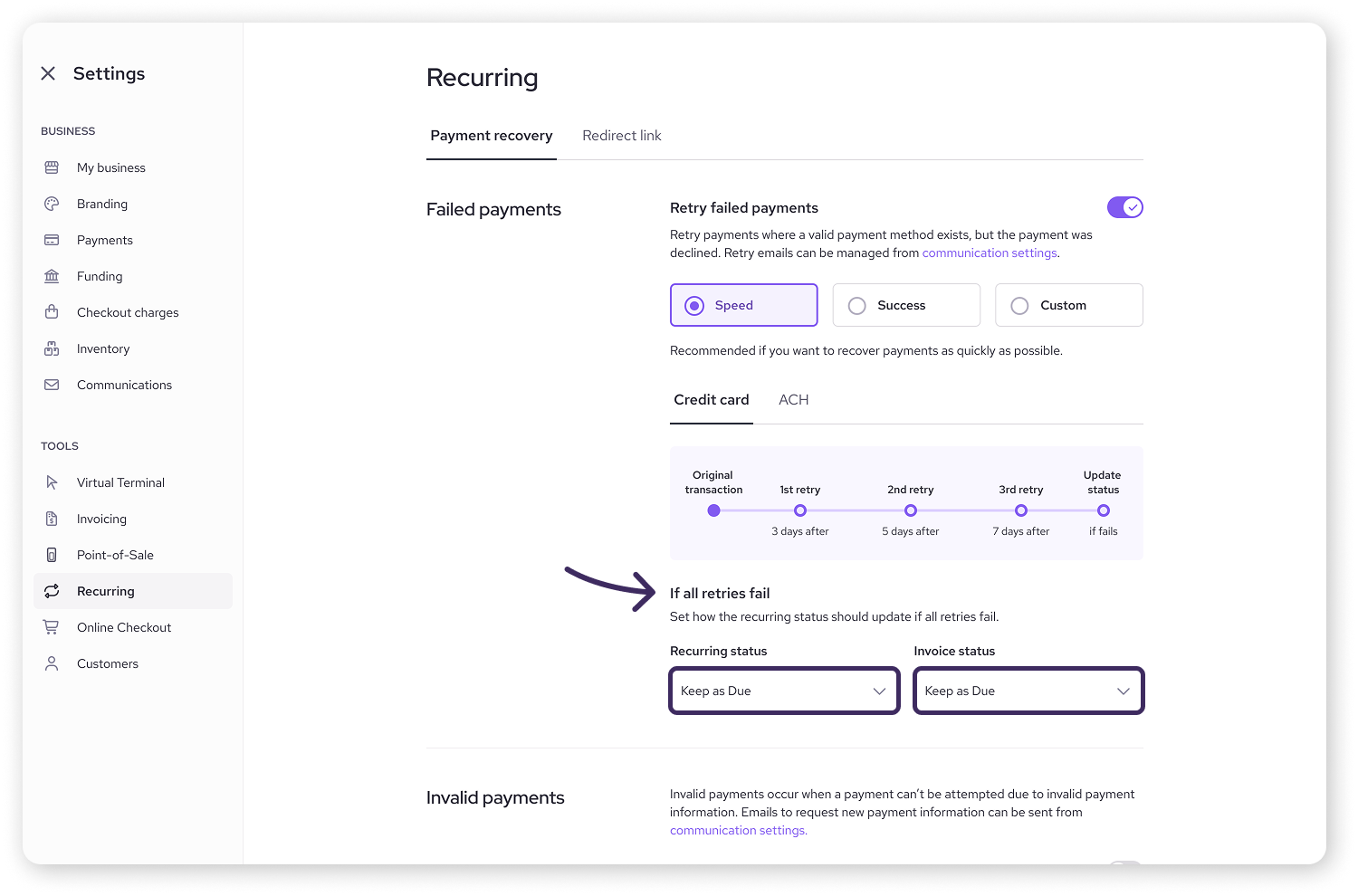

Failed retries

If all in the series of automatic retries fail, you can trigger a change in status of the recurring plan, the associated invoice, or both.

Select a dropdown to edit the desired status

Select Keep as Due or Set to cancelled

Invalid payments

If a customer’s payment information is invalid, you can choose to set a grace period before their recurring or invoice status is updated.

Select Restrict grace period

Enter the number of days for the grace period

Under After grace period, select a desired status for the recurring plan or the associated invoice

If a payment still isn’t received after the grace period, the statuses will automatically update.

Next steps

By proactively managing and preventing failed payments, you can improve your cash flow and customer retention.

To learn more about managing your recurring payment plans and subscriptions, including editing plans and handling payments, see our Manage recurring payment plans article.

For information on managing customer credit cards, such as updating card details or processing refunds, please refer to the Managing customer credit cards article.

FAQ

How will I know if a payment has failed?

You will be sent an email notification if you've turned on 'Transaction Declined' emails in your email settings. You can adjust these settings within All Tools > Settings > Email Settings.

Can I set up automatic reminders to customers about expired cards?

Yes, Helcim has a setting to automatically request updated card information from customers before their card expires.

What should I do if a customer consistently has failed payments?

If a customer repeatedly has failed payments, it's best to communicate with them directly to resolve the issue, which could include updating their payment method or discussing alternative payment arrangements.