Want to receive your hard-earned money quickly and efficiently? Setting up your bank deposits is a crucial step after signing up for a Helcim account.

This guide will walk you through the process of linking your bank account, so you can start receiving payments right away.

In this article

Link an account using Instant Link

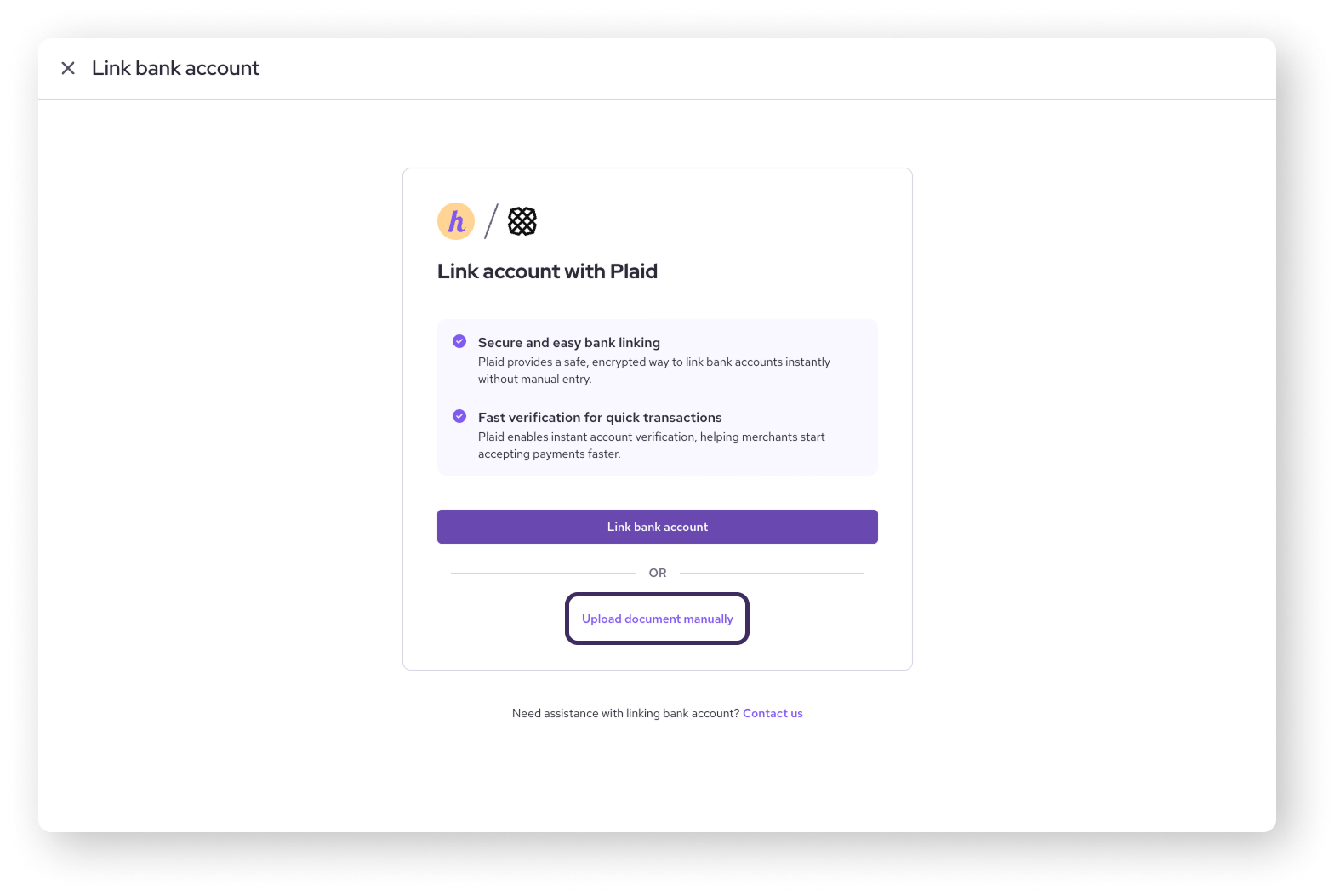

The easiest and fastest way to link your bank account is through Instant Link, which utilizes Plaid, a secure financial technology company that connects your bank account to Helcim.

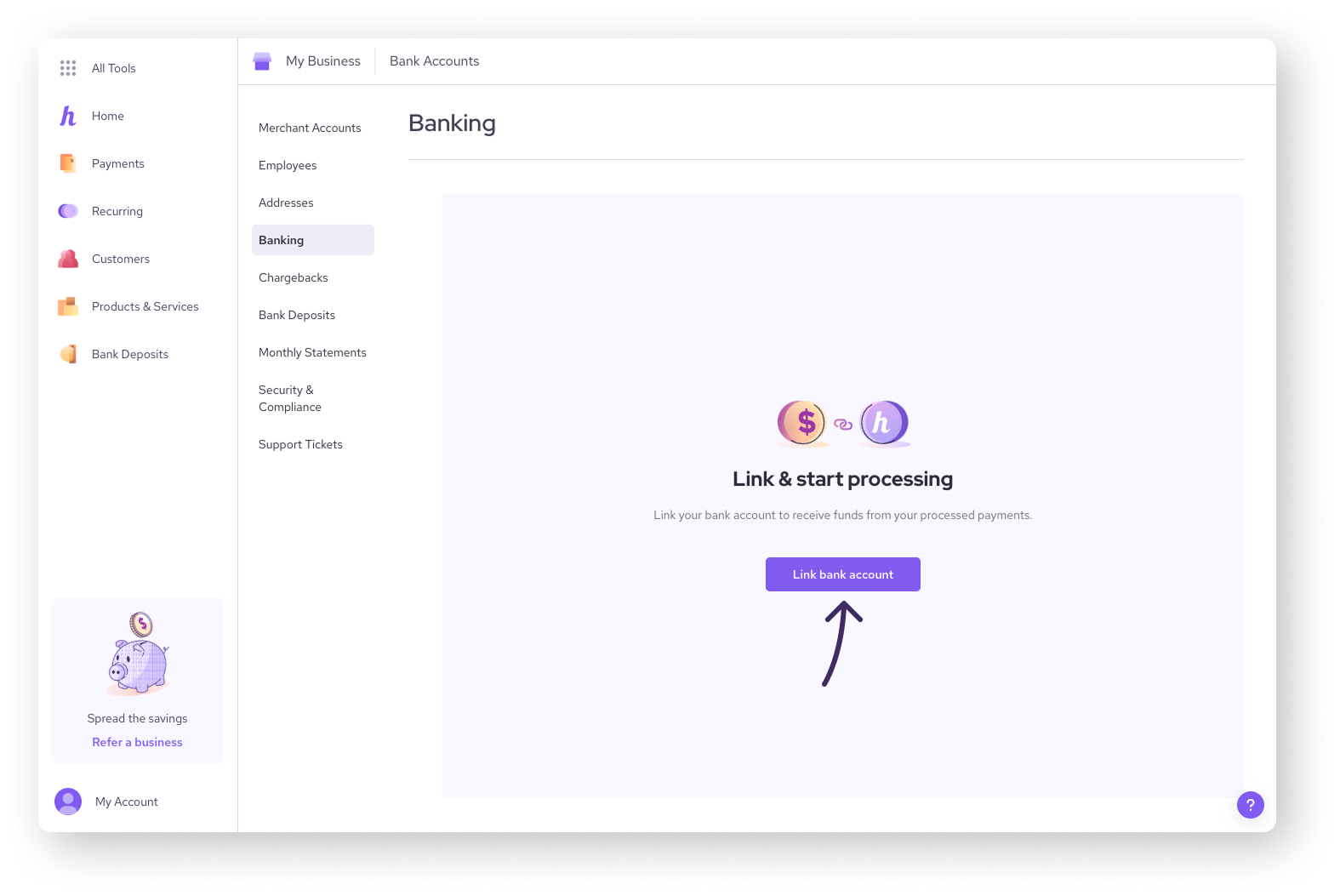

Log into your Helcim account and select All Tools from the home screen.

Scroll down and select My Business, then Banking.

Click on Link bank account.

Click on Link bank account again.

Click Agree to authorize linking your bank account.

Create an account with Plaid or select Continue as guest.

Select your bank from the list or search for it.

Log in using your online banking credentials.

Select a specific account to link.

Wait for the confirmation that your account is linked.

Link an account by uploading a void cheque

If you prefer not to use Instant Link, you can also submit a void cheque, bank letter, or direct deposit form to link your account.

Log into your Helcim account and select All Tools from the home screen.

Scroll down and select My Business, then Banking.

Click on Link bank account.

Click on Upload document manually.

Drag and drop your file or click browse to upload.

Your file will be reviewed within 1-2 business days. You can check back on your Helcim dashboard for an update on the status of your bank account link.

Understanding deposit timelines and delays

After you've processed your first transaction, we'll deposit your funds directly into your bank account.

For our Canadian merchants, it typically takes 1-2 business days for credit card transactions to deposit.

If you're a US merchant, there’s a chance you can receive your money from credit card transactions as early as the next business day morning through our Faster Deposits feature.

Your bank account needs to be on the RTP or FedNow networks to be eligible.

To check if your bank is eligible, visit the following links:

Any payments made through ACH (or EFT) typically take 5-6 business days to appear in your account.

| Regardless, your first batch may take slightly longer due to a review process on new merchant accounts. Please allow approximately 3 business days for credit card transactions and 7 business days for ACH payments. |

Next steps

Now that you have linked your bank account, you may be wondering when to expect for your first deposit.

| The next article in this series will guide you through funding timelines for initial batches and going forward. |

FAQs

What is Plaid?

Plaid is a financial technology company that acts as a secure intermediary between banks and financial applications, enabling you to securely connect your bank account to Helcim.

How do I get a void cheque?

Most banks allow you to access and print a void cheque online through your online banking platform. For more information, refer to your bank’s help center.

Why is there a delay on my first deposit?

Helcim reviews the first batch of all new merchants to ensure the security of your account and prevent fraudulent activity. This review process helps protect your business and your customers.

Keep an eye out on your email inbox, as our Trust & Safety team may reach out to you for more information. The sooner you respond, the sooner we can complete our review process.

What are Faster Deposits?

Faster Deposits is a new feature that offers next-business-day deposits for credit card transactions for US merchants.

To learn more visit this article.

Why does the bank account number in my Helcim account look different from my actual number?

If you used Plaid’s Instant Link to connect your bank account and your bank is JP Morgan Chase or PNC Bank, you might notice that the account number in your Helcim account is not the same as your actual bank account number.

Don't worry, this is perfectly normal! Plaid uses a security measure that replaces your actual account number with a special code, called a "token," to keep your banking information safe. This is why you might see a different number than expected.