Waiting for your deposits can feel a bit like waiting for pizza - you want to know when it's going to arrive.

This article will walk you through how to monitor your deposit statuses so you’re not left guessing.

In this article

Viewing your bank deposits

You can view your bank deposits and track their status within your Helcim account:

Open the All Tools menu.

Select Bank Deposits.

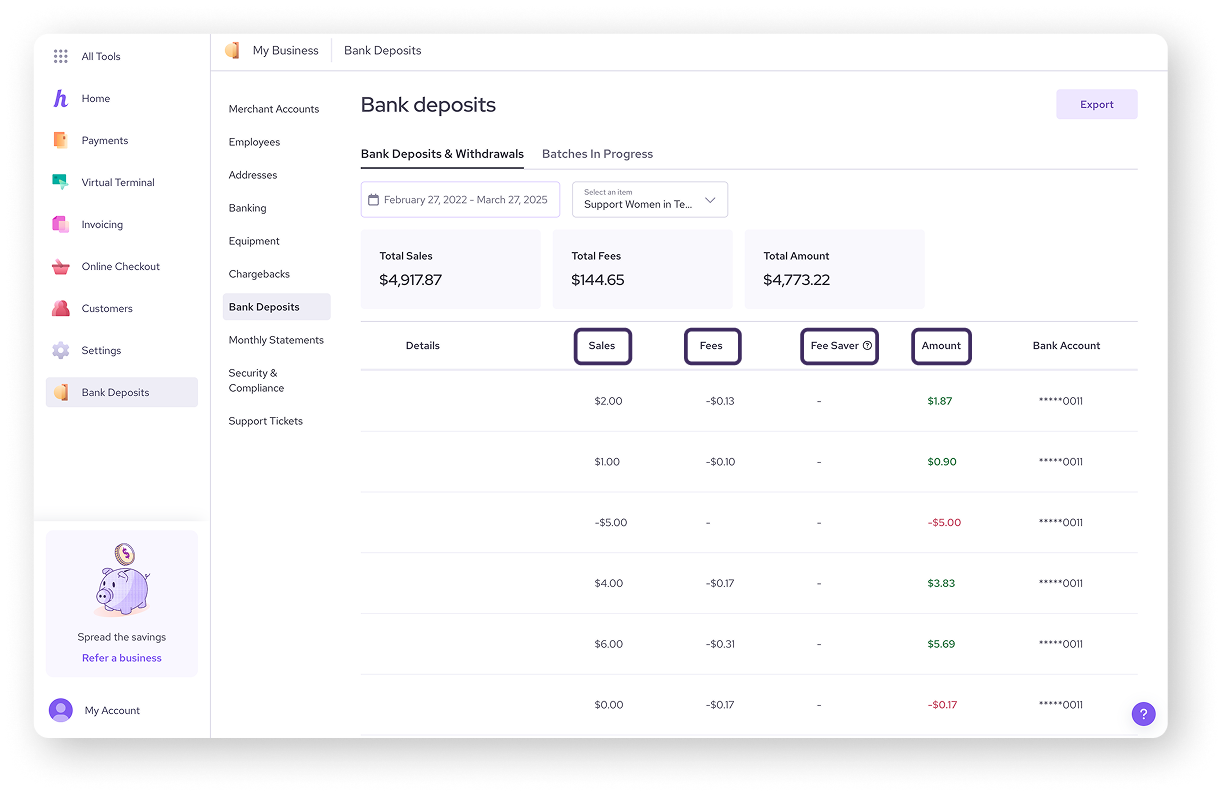

Under the Bank Deposits and Withdrawals tab, you'll find a breakdown of your deposit information.

The Batches In Progress tab shows you the status of your current batches, transfers, and any in-progress deposits or withdrawals.

Understanding deposit information

The Bank Deposits page provides key details to help you reconcile your payment information:

Sales: This is the total value of the transactions included in a specific deposit.

Fees: This shows the amount of processing fees associated with the batch.

Fee Saver: If you have Fee Saver (surcharging) enabled, this is where you would see the amount you passed onto the customer.

Amount: This is the net amount that was deposited into your bank account after fees were deducted.

Viewing deposits in the Payments tool

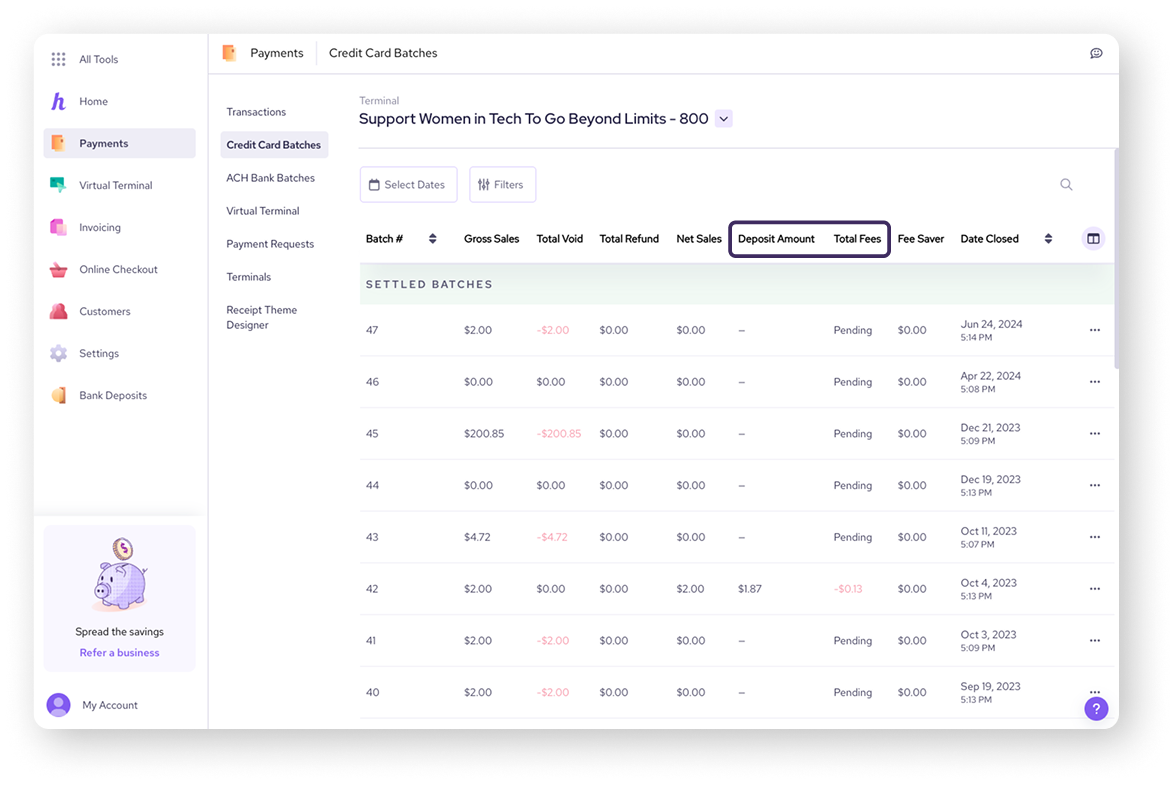

You can also view deposits under the Credit Card Batches or ACH Bank Batches sections, within the Payments tool.

Each line item will provide more detailed information:

The deposit amount column shows your total processed sales, minus any chargebacks, refunds, or returns.

The total fees column shows your fees.

Updating your bank account information

You may want to update your bank account information if you’ve recently changed banks, or are looking to change your account to one that is compatible with Faster Deposits. You can update this information within the Banking page in the My Business tool.

| For the full steps on how to do this, visit this article. |

FAQ & Troubleshooting

How long do deposits take?

Typical deposit timelines are:

1 to 2 business days for credit card transactions

4 to 5 business days for bank (ACH) transactions

You may receive next day deposits if your bank is eligible. To learn more about this and other factors affecting deposit speed, please see our article: How long do deposits take at Helcim?

How do I know if my deposit is arriving via Faster Deposits?

The easiest way to tell is to look at the Date Closed on your batch compared to the date the funds arrive in your bank account. If the funds land the very next business day, you are likely utilizing Faster Deposits.

In Canada: If you bank with one of the Big 6 banks and settle your batch before 7:00 PM MT, your credit card funds will arrive the next business day (see eligible banks here).

In the US: If your bank participates in the RTP or FedNow networks and you settle before 7:00 PM MT, your credit card funds will arrive the next business day.

If your funds are taking 2 business days or longer, it may be because the batch was settled after the cut-off, exceeded the $25,000 limit (in Canada), or your bank does not yet support the necessary real-time networks.