Running a business comes with many costs, and credit card processing fees can significantly impact your profits.

Helcim Fee Saver is a feature designed to help you manage these costs by allowing you to pass processing fees on to your customers. This article will provide a comprehensive overview of Helcim Fee Saver, explaining how it works and what you need to know to use it effectively.

In this article

What is Helcim Fee Saver?

When you run a business and accept credit cards, you pay a processing fee for each transaction that eats into your profits. Helcim Fee Saver is a feature that helps you manage these fees by giving you the option to pass them on to your customers.

| When your customers choose to pay with a credit card, or a debit card that can be processed like a credit card, you can have them cover the processing costs. This can significantly reduce or even eliminate the fees your business pays. |

Which tools does Helcim Fee Saver work with?

Helcim Fee Saver is available for:

Online payments | In-person payments |

✅ Pay Now Invoicing ✅ Payment Requests ✅ Payment Pages ✅ Integrations with HelcimPay.js | ✅ Helcim Smart Terminal |

Fee Saver is not available for:

Online payments | In-person payments |

❌ Recurring Invoicing ❌ Recurring Payments ❌ Virtual Terminal ❌ Integrations with WooCommerce, Xero, or Quickbooks Online | ❌ Helcim Card Reader ❌ Manual entry payments through the Helcim POS |

How Helcim Fee Saver works

Helcim Fee Saver functions in two ways, depending on whether you're accepting payments in person or online.

In-Person Payments

If you accept payments in person using the Helcim Smart Terminal, you can enable Fee Saver via a toggle. When a customer pays with a credit card, the processing fee is added to the transaction and appears as a "surcharge" on their receipt.

Online Payments

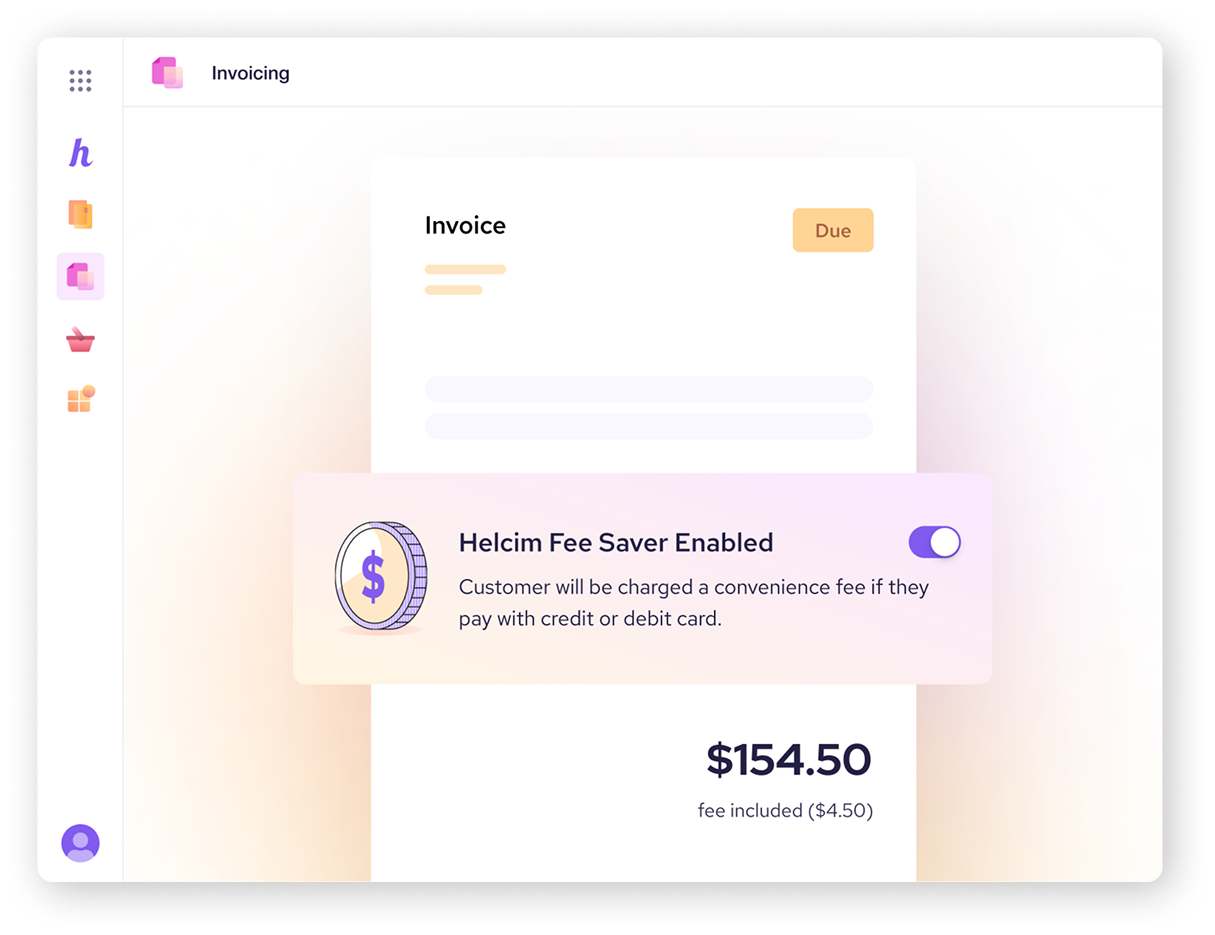

For online payments through Helcim Invoices, Payment Pages, Payment Requests, or HelcimPay.js, Fee Saver can also be enabled with a toggle. In this case, when a customer chooses to pay with a credit card instead of ACH, the fee is passed on to them and is shown as a "convenience fee" on their receipt.

Here’s a breakdown of how fees are applied when Fee Saver is enabled.

When a customer uses | You pay | Customer pays |

Credit card (in-person) | 0% | 2.40% in Canada 3% in the US |

Credit card (online) | 0% | 3% +0.5% for AMEX +1.5% for international cards |

ACH (online) | 0.5% + 25¢ capped at $6 for transactions under $25,000 | 0% |

Key benefits of Helcim Fee Saver

Helcim Fee Saver provides the following key benefits to businesses:

Easy activation

Fee Saver can be enabled with a simple toggle within the compatible Helcim tools. This eliminates the need for complex setup procedures.

Automated compliance

Helcim's system uses preset rates that align with card brand rules, reducing the need for manual calculations of fees.

The feature is also automatically disabled in restricted regions to help you comply with regulations.

Versatility

Fee Saver can be used across Helcim's payment tools, including both in-person and online payment methods.

Transparency

Fees are clearly displayed to customers in their order summary (before they make a payment) as either a "surcharge" for in-person transactions or a "convenience fee" for online transactions. This ensures clarity and helps maintain trust with your customers.

Next steps

If you're interested in lowering your credit card processing costs, consider enabling Helcim Fee Saver in your Helcim account.

| For instructions on how to do this, head to our article on Enabling Fee Saver. |

FAQ

Is Helcim Fee Saver available for all merchants?

Online Fee Saver is available for all merchants, but requires ACH payments to be enabled to function.

In-Person Fee Saver on the Smart Terminal does not require ACH but is not available in the following regions.

In the USA:

Connecticut

Colorado

Maine

Massachusetts

Oklahoma

In Canada:

Quebec

Does Fee Saver work for debit cards?

It depends on how the debit card is processed. Some debit cards in the U.S. and Canada (like those with a Visa or Mastercard logo) can be used similarly to credit cards.

If a customer uses one of these "credit-enabled" debit cards in person by swiping or signing, it's processed as a credit card transaction, and credit card processing rates apply. To process it as a debit card, the customer must select "debit," choose their account, and enter their PIN.

Regardless of how the debit card is processed, in-person debit card payments cannot be surcharged. Helcim's system recognizes debit cards to prevent surcharges from being applied.

For online payments, if a credit-enabled debit card is used, it's treated as a credit card payment. So, if Fee Saver is enabled for online payments, these debit cards will be charged a convenience fee. The customer can avoid this fee by paying via ACH/EFT instead.

Does online Fee Saver apply to payments made with Google Pay?

No, not at this time. When a customer pays using a digital wallet like Google Pay, we don't receive all the card details we need at the time of payment to apply the convenience fee.

These transactions will be processed as a standard credit card payment, and all regular processing fees will apply to your business.

Will my customers be aware that their invoices have Helcim Fee Saver?

Yes, customers are notified of the fee when they select credit card payments, and the fee is displayed as a separate line item on their invoice and receipt. They will be given the option to pay with ACH if they don’t want to pay the additional fee.

What if my customer refuses to pay the extra fees?

Customers can choose to pay with ACH payments, debit cards (selecting the ‘debit’ payment method), or cash, which do not incur the fee.