Level 2/3 Interchange Optimization

What are Level 3 interchange rates?

Businesses processing business-to-business (B2B) or business-to-government (B2G) transactions can qualify for Level 3 interchange rates when they send additional transaction details to the card brand.

When a transaction qualifies for Level 3 interchange rates, it will typically qualify for a lower interchange fee compared to standard interchange rates. Businesses can see savings ranging from 0.5% to 1.5% or more on their transaction costs when they qualify for Level 3 interchange rates. This can represent a significant reduction in expenses, particularly if your business processes a high volume of large B2B transactions.

To qualify for Level 3 interchange rates, businesses need to:

- Provide the required Level 3 data with the transaction

- Accept payment from a customer using a Level 3 eligible credit card

What type of data is needed for Level 3 interchange rates?

To qualify for Level 3 interchange rates, in addition to providing Level 1 and Level 2 data, the transaction needs to include:

- The 'shipping from' and destination postal codes

- Invoice or purchase order

- Commodity code

- Product details such as the SKU or other identifiers

- Quantity

- Unit of measure

- Other data, when applicable, such as:

- Duty, freight or shipping costs, number, and discounts.

Using Helcim Level 2/3 Interchange Optimization

When you process a transaction, Helcim’s Level 2/3 Interchange Optimization* automatically retrieves and optimizes this data on your behalf. This means that most B2B transactions should now automatically qualify for the lower interchange rates offered for Level 2 and Level 3 transactions. Your monthly statement will note your savings for these transactions under Helcim’s Level 2/3 Interchange Optimization Savings Fee.

What can these savings look like?

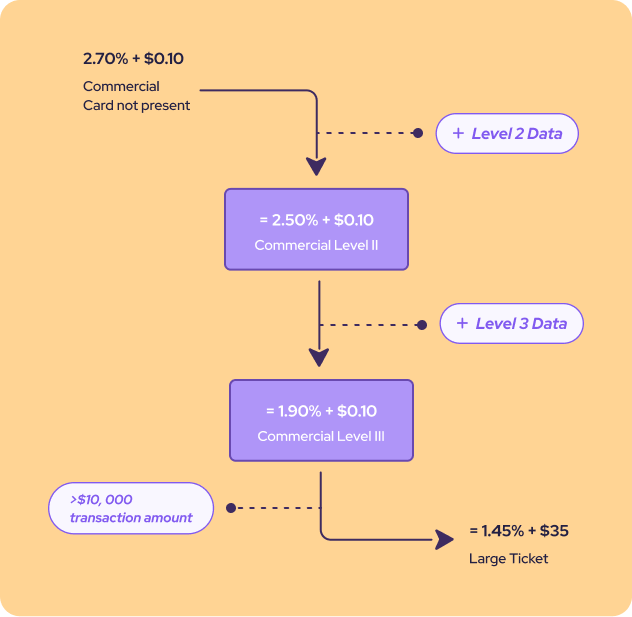

In the chart below, you’ll see how the interchange fee for a $10,000 transaction changes depending on if it qualifies for Level 2 or Level 3 interchange rates. These savings can be substantial on large ticket purchases which are common for B2B transactions.

An example of Interchange reduction by Level 2 / 3 Interchange Optimization

Which cards qualify for Level 3 Interchange rates?

Many corporate and purchasing cards qualify for Level 3 rates, but most business credit cards do not. Business cards differ from corporate cards in that the cardholder is usually liable for purchases rather than the company. It is common for small businesses to have business credit cards and larger companies to have corporate credit cards.

Credit cards eligible for Level 3 processing include purchase cards, corporate, government spending accounts, GSA SmartPay cards and fleet. There is no simple way to quickly identify if a credit card qualifies for Level 3 rates.

If your customer’s card only qualifies for Level 2 interchange rate, providing Level 3 data does not negatively affect the cost of the transaction.

*Note: Helcim Level 2 Interchange optimization is available to all merchants from June 2023 onwards. Helcim Level 3 Interchange optimization will be available (another further set of potential savings) to all US B2B merchants by December 2023 and Canadian merchants by March 2024