Want to offer your customers the convenience and security of paying directly from their bank account?

Helcim allows you to securely store bank account details for processing ACH (Automated Clearing House) payments in the US (PAD, or Pre-Authorized Debit payments in Canada). This guide covers adding accounts (either by you or by requesting info from the customer), editing, deleting, and viewing the necessary authorizations.

In this article

Adding a bank account for a customer

If you have the customer's bank details handy, you can enter them yourself. This process also initiates the request for the customer to authorize debits.

Open the All Tools menu, and then select Customers.

Select a customer.

In the menu on the left, click ACH Bank Accounts.

Click the box marked with a + symbol.

Enter the bank account information:

Type: Select Checking or Savings.

Personal/Business: Select Personal or Corporate.

Routing Number (US only): Enter the routing number for the bank account.

Transit Number and Bank ID (Canada only): Enter the transit and institution numbers for the bank account.

Bank Account Number: Enter the account number.

Enter the account holder’s name and address.

Click Send Request. This saves the account information and sends an email to the customer asking them to review the details and approve the ACH or PAD agreement, allowing you to process payments from this account.

Requesting bank account information from a customer

Don't have your customer’s banking details? You can send a secure request for the customer to provide them.

Open the All Tools menu, and then select Customers.

Select a customer.

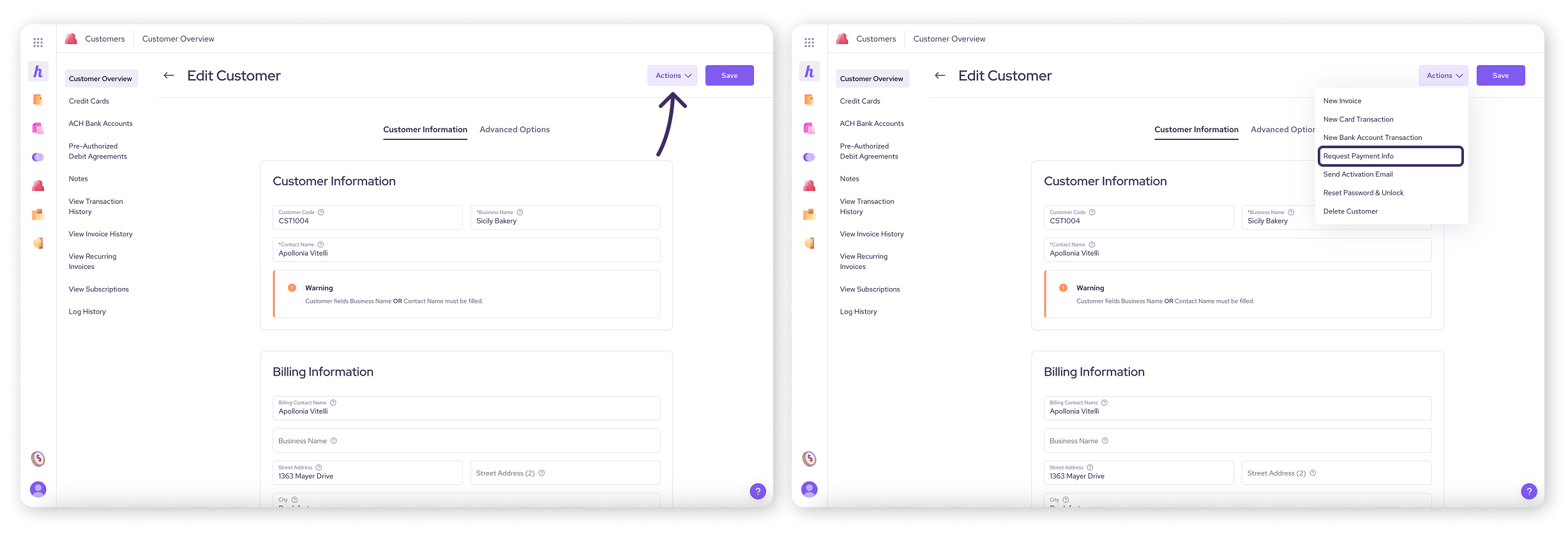

Click the Actions button in the top right corner.

Select Request Payment Info.

Confirm the customer's email address is correct.

Click Send.

The customer will receive an email with a secure link to enter their bank information and authorize a bank payment agreement. You'll be notified when they complete it, and the details will be saved to their profile.

Editing a bank account

To edit an already saved bank account:

Open the All Tools menu, and then select Customers.

Select a customer.

In the menu on the left, click ACH Bank Accounts.

Select a bank account.

Make any necessary changes to the account fields.

If the customer has multiple bank accounts saved, you can mark this one as the preferred default by clicking Make Default at the top.

To save changes to a bank account, you’ll need to send a new ACH or PAD agreement to the customer. Click Send New Agreement to do this.

Deleting a bank account

To remove a saved bank account:

Open the All Tools menu, and then select Customers.

Select a customer.

In the menu on the left, click ACH Bank Accounts.

Select a bank account.

Click the Delete button.

Confirm by clicking Yes.

Viewing Pre-Authorized Debit (PAD) agreements

The PAD (or ACH authorization) agreement is the customer's formal consent for you to withdraw funds from their account.

Open the All Tools menu, and then select Customers.

Select a customer.

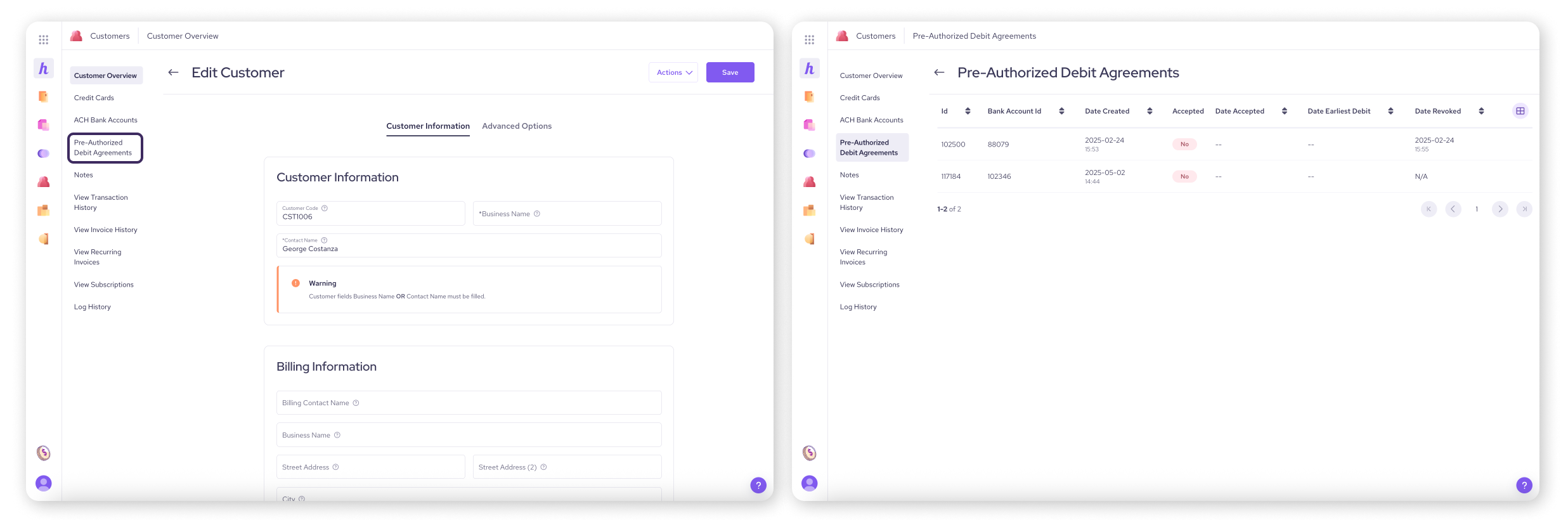

In the menu on the left, click Pre-Authorized Debit Agreements.

Any active or pending agreements associated with the customer's saved bank accounts will be displayed here, along with their status.

| For Canadian merchants Businesses operating in Canada must adhere to specific rules set by Payments Canada regarding Pre-Authorized Debits (PADs). Ensure you are familiar with requirements for authorization, cancellation, and recourse rights. |

Next steps

Learn how to process ACH payments using Helcim’s payment tools

Learn how to manage customer credit card information in your Card Vault

Let customers manage their own details: How to use the Customer Portal

FAQs

What's the difference between ACH and PAD?

They are both types of direct bank payments. ACH (Automated Clearing House) is the term generally used in the United States, while PAD (Pre-Authorized Debit) is commonly used in Canada. Functionally, they allow you to debit funds directly from a customer's bank account with their permission.

Does the customer have to approve saving their bank details?

Yes. Whether you add the details or request them, the customer must formally agree to the Pre-Authorized Debit / ACH authorization agreement before you can process payments from that account. This is typically done via an email verification process initiated when the account is added or requested.

Can customers add their own bank accounts?

Yes, if you enable the Customer Portal and configure the settings to allow it, customers can log in securely and add their own bank account details and provide authorization.

Where can I find the specific PAD rules for Canada?

We recommend reviewing the official resources from Payments Canada for the most current and detailed rules regarding Pre-Authorized Debits.

What if my customer’s bank blocks the ACH payment?

If your customer uses an ACH authorization or "debit block" service, their bank may require Helcim’s ACH Company ID to allow the transaction to go through. For customers located in the US, you can provide them with Helcim’s ID: 9899637003.

Note: This ID only applies to transactions involving US bank accounts.