As a business owner, you're always looking for ways to be more efficient and save money. What if there was a way to lower your costs that was built right into the system?

That’s where Level 2 and 3 optimization comes in. It’s a bit of an industry secret, but if you sell to other businesses or government agencies, it’s an effective way to lower your credit card processing fees.

In this article, we’ll break down what it is, how it works, and what you can do to qualify for lower rates.

In this article

First things first: what are interchange fees?

Before we dive into the savings, let's talk about the biggest piece of the credit card processing puzzle: interchange fees.

| Think of interchange as the wholesale cost of running a transaction. It’s a fee that your business pays to the customer's card-issuing bank (like RBC or Chase) every time you process a credit card. |

This fee is set by the card brands (Visa and Mastercard) and it’s the same for every payment processor.

What is Level 2 and 3 data?

While the base interchange rates are set, you can qualify for lower rates by providing more information about a transaction. This extra information is sorted into three levels.

Level | Description | Data included |

Level 1 | The basic information collected in every credit card transaction. |

|

Level 2 | Adds more detail, primarily for tax and accounting purposes. |

|

Level 3 | The most detailed level, including specific line-item information from an invoice or order. |

|

| To put it simply: Level 1 data shows that a customer spent $100 at your store. Level 3 data shows that the customer spent $100 to buy two widgets at $50 each. |

How do I provide Level 2 and 3 data?

Luckily, you don’t have to do very much! Helcim’s platform is built to automatically gather and send this Level 2 and 3 data for you whenever possible.

| This helps reduce your interchange costs, without you having to manually submit data to the card networks. |

That said, there are some best practices you can follow to ensure the data qualifies for better rates. Find out more in this section below.

How to see how much you’re saving

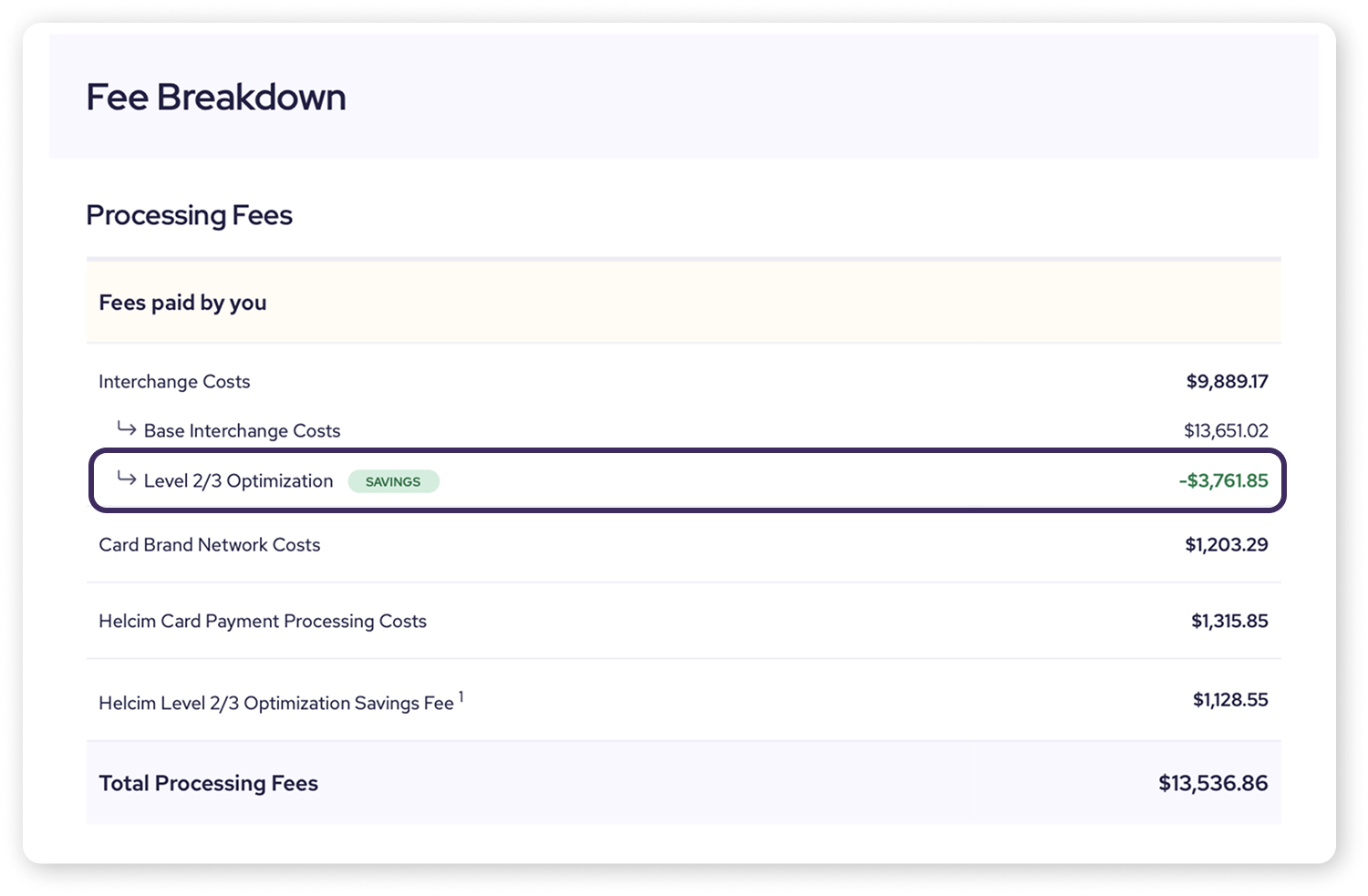

You’ll see exactly how much you saved from this optimization on your monthly statements in the Fee Breakdown section.

| For providing this service, we retain a 30% fee on the savings generated by the lower interchange rates. |

How does providing more data save you money?

When you provide this extra data, the card brands and the customer's bank see the transaction as more secure and less of a fraud risk. This is especially true for business-to-business (B2B) and business-to-government (B2G) purchases, which are often made with corporate or purchasing cards.

Because there's more information to verify the purchase, Visa and Mastercard reward you by charging a lower interchange fee.

| These savings can be significant, sometimes between 0.5% and 1.5% of the transaction amount. On large B2B purchases, that adds up quickly. |

How to improve your data for the best rates

While Helcim automates this process, you can help improve the quality of the data we send by following a few best practices.

Process payments with itemized invoices. When you build your inventory in Products and add those items to an invoice, all the rich Level 3 data (like descriptions, quantity, and unit cost) gets included automatically.

Always include tax amounts. Ensure your Tax Settings are configured correctly and that taxes are applied at an invoice or line-item level. This is a key piece of Level 2 data.

Keep your business details up to date. Double-check that your legal business address in your Addresses tab is accurate.

Following these steps gives you the best chance of having your transactions verified by the card brands, which helps you get your savings faster.

| Good to know: Card network programs are always evolving. Level 2 payments will be phased out by Visa in the early months of 2026, so Level 3 data will become important to continue receiving optimized rates. |

Next steps

Now that you understand how interchange optimization works, you can see how powerful detailed invoicing and product management can be. Here are a few articles to help you get the most out of your Helcim account:

Learn how to add products to your Helcim account

Learn how to add products as line items when creating an invoice

Learn how to view your monthly statements to see your Level 2/3 discounts

FAQs

Do I need to do anything to qualify for Level 2/3 savings?

Helcim's system automatically submits the data for you. That said, following the best practices listed above will help increase the likelihood that you qualify for the best possible rates.

Why aren't my savings applied instantly?

Some card brand programs, like Visa's, now include a verification step for data quality. This may cause a delay, with your savings appearing as a retroactive credit on one of your next few statements. Once your data quality is consistently verified by Visa, savings are then applied instantly at the time of the transaction.

How much can I actually save?

Savings can range from 0.5% to 1.5% on a transaction, which can be very significant for businesses with large average transaction sizes.

Does this apply to every transaction?

These lower rates typically apply when your customer pays with a corporate, purchasing, or government card from Visa or Mastercard. Standard consumer credit cards generally don't qualify for these optimized rates.