Keeping your invoices organized and tracking your tax obligations are essential for operating your business. Helcim's invoice and tax reports provide you with the detailed information you need to reconcile your accounts, monitor payments, and ensure you're collecting and reporting taxes correctly.

| To learn how to access these reports and others, read this article first: Accessing and Generating Reports. |

This article will walk you through using the 'Invoice Line Item Detail' report, 'Gross Income Detail' report, 'Tax Summary' report, and 'Invoice Level Detail' report to help you keep your financials in order.

In this article

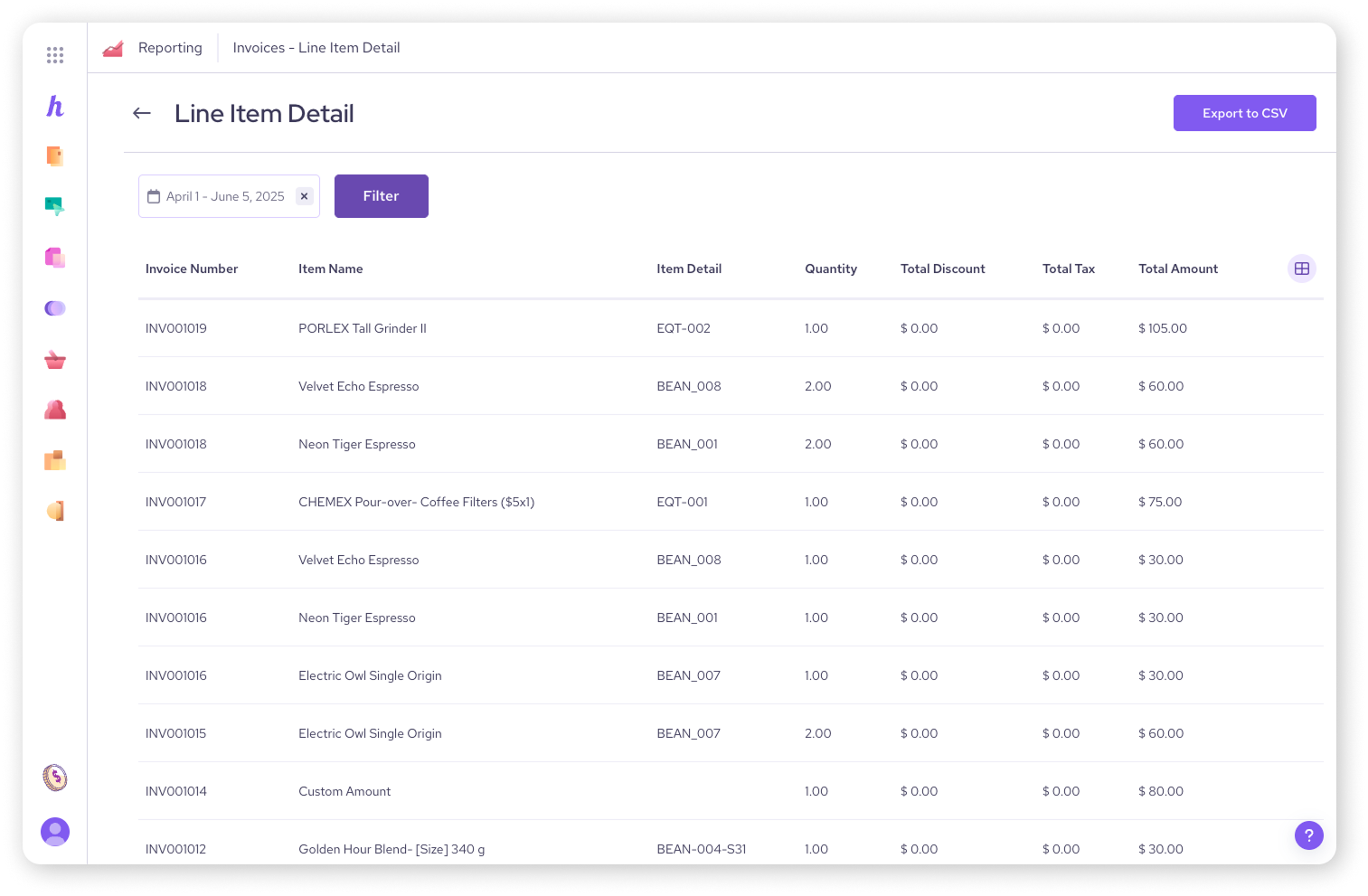

Invoice line item detail report

The 'Invoice Line Item Detail' report provides a granular view of every item on your invoices, helping you to understand what was purchased and at what quantity.

Report columns include:

Invoice number: The unique identifier for the invoice.

Item name: The name of the product or service listed on the invoice.

Item detail: Additional details about the item on the invoice.

Quantity: The number of units of the item.

Total discount: Any discount applied to that specific line item.

Total tax: The amount of tax applied to that specific line item.

Total amount: The total price for that specific line item.

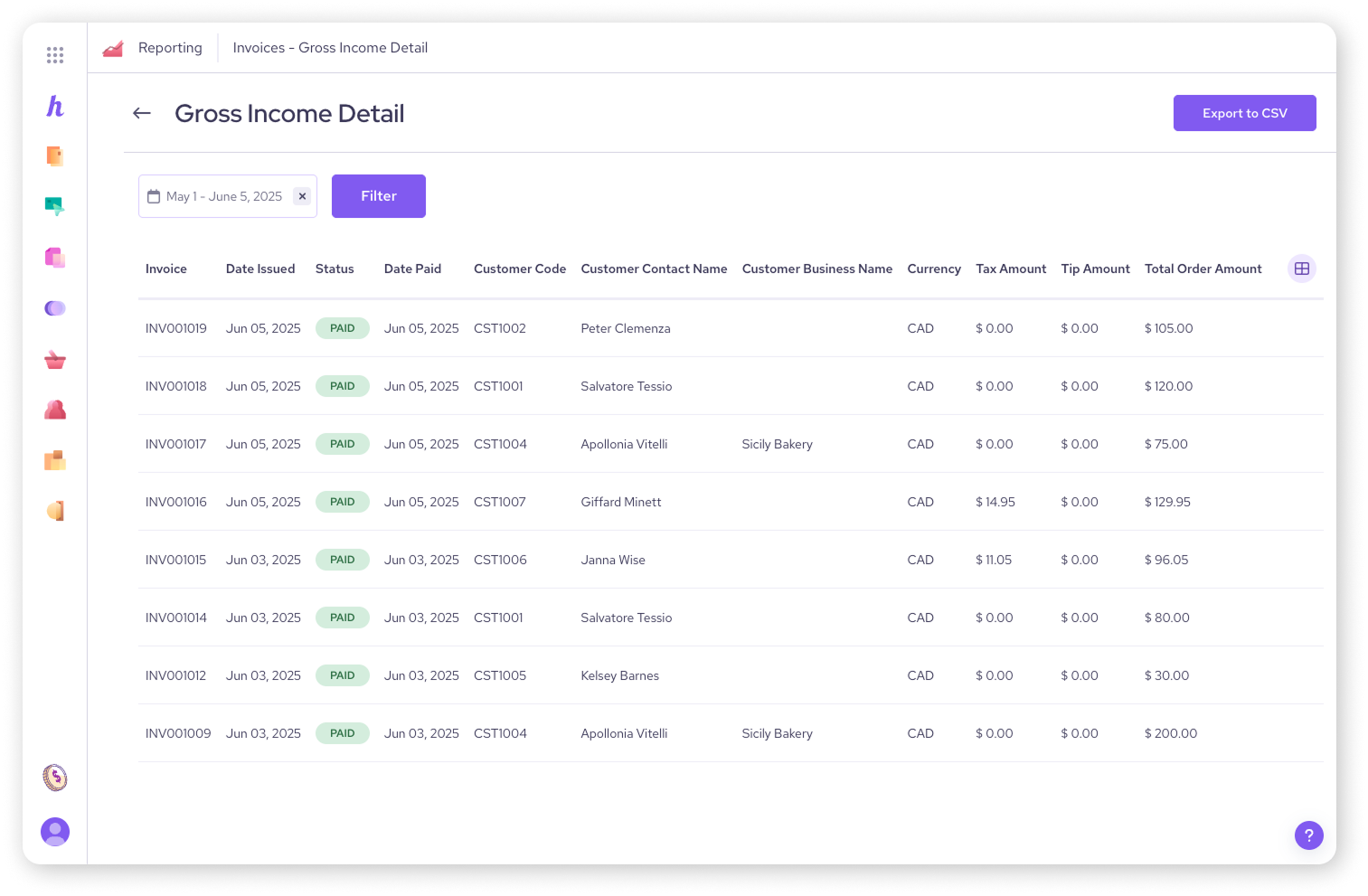

Invoice gross income detail report

The 'Gross Income Detail' report gives you a broader financial overview of your invoices, including their status, payment dates, and overall amounts.

| Clicking on an entry in this report will take you directly to that specific invoice, where you can view or edit it, or take other actions. |

Report columns include:

Invoice: The invoice number.

Status: The current status of the invoice (e.g. Paid, Due).

Date issued: The date the invoice was created.

Date paid: The date the invoice was paid.

Customer code: A unique code for the customer.

Customer contact name: The name of the customer.

Customer business name: The name of the customer's business (if applicable).

Currency: The currency of the invoice.

Tax amount: The total tax amount on the invoice.

Tip amount: Any tip amount included on the invoice.

Total order amount: The grand total of the order on the invoice.

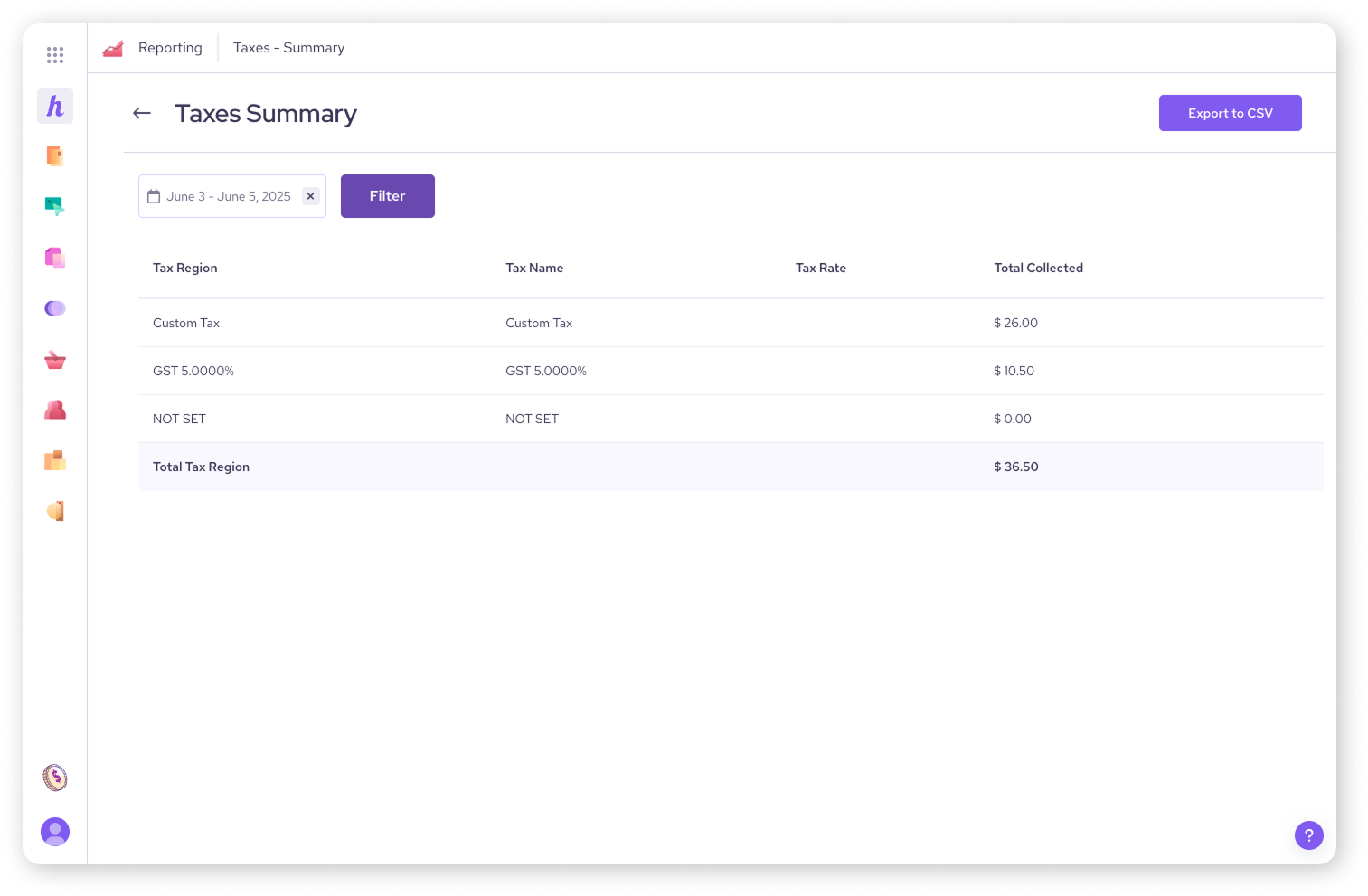

Tax summary report

The 'Taxes Summary' report provides a consolidated view of the taxes you've collected across different tax regions and names, along with their rates and total collected amounts.

Report columns include:

Total tax region: The region where the tax was applied.

Tax name: The name of the specific tax (e.g. Sales Tax, GST, Custom Tax).

Tax rate: The percentage rate of the tax.

Total collected: The total monetary amount collected for that tax.

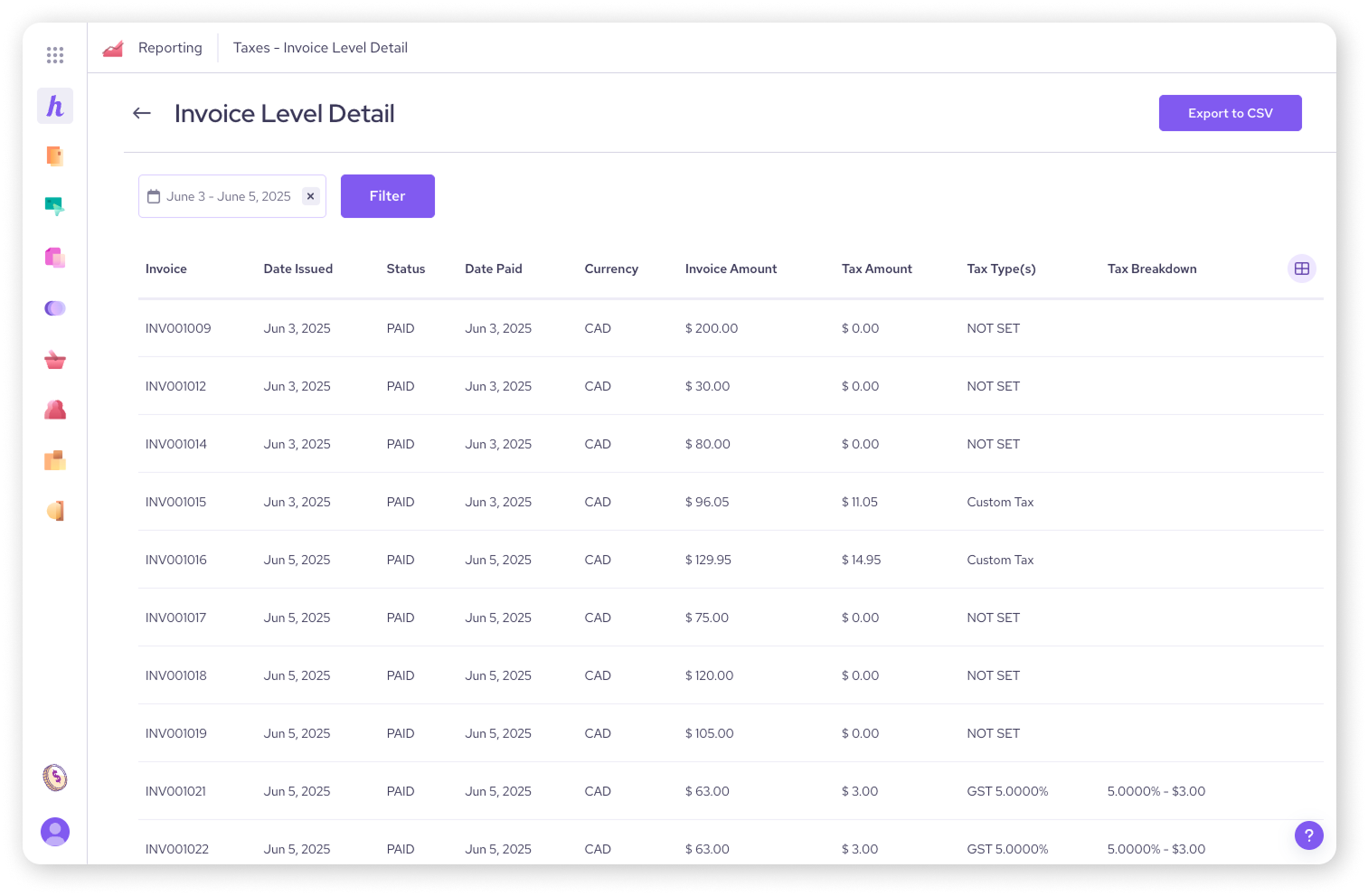

Tax invoice level detail report

For a detailed breakdown of tax collected on individual invoices, the 'Invoice Level Detail' report is your go-to. It shows which taxes were applied to each invoice and their specific amounts.

Report columns include:

Invoice: The invoice number.

Date issued: The date the invoice was created.

Status: The current status of the invoice.

Date paid: The date the invoice was paid.

Currency: The currency of the invoice.

Invoice amount: The total amount of the invoice before tax.

Tax amount: The total tax amount on the invoice.

Tax type(s): The type(s) of tax applied to the invoice.

Tax breakdown: A detailed breakdown of how the tax was calculated on the invoice.

| For invoices to appear in the reports covered in this article, their status must be Paid (or Due with a partial payment). |

Next steps

To ensure operational efficiency and accountability, consider reviewing your user activity and system logs within Helcim.

| Read our next article: User activity and system log reports. |

FAQs

Why can't I see all my invoices in the tax reports?

Tax reports only reflect taxes collected on paid or partially paid invoices within the selected date range.

Can I see specific product details in the invoice gross income detail report?

This report focuses on the overall invoice financial details. For product-level details, refer to the invoice line item detail report.

How do I handle discrepancies in tax calculations?

Ensure your tax rates are correctly set up in your Helcim account and review the invoice level detail report for specific breakdowns.