Curious about your daily sales trends or the breakdown of your credit card transactions? Helcim's sales and revenue reports provide you with the essential data to understand where your money is coming from, track your performance, and make informed financial decisions.

| To learn how to access these reports and others, read this article first: Accessing and Generating Reports. |

This article will guide you through the 'Daily Sales' report , 'Credit Card Summary' report , and 'Credit Card Detailed' report, helping you unlock key insights into your business's financial health.

In this article

Daily sales report

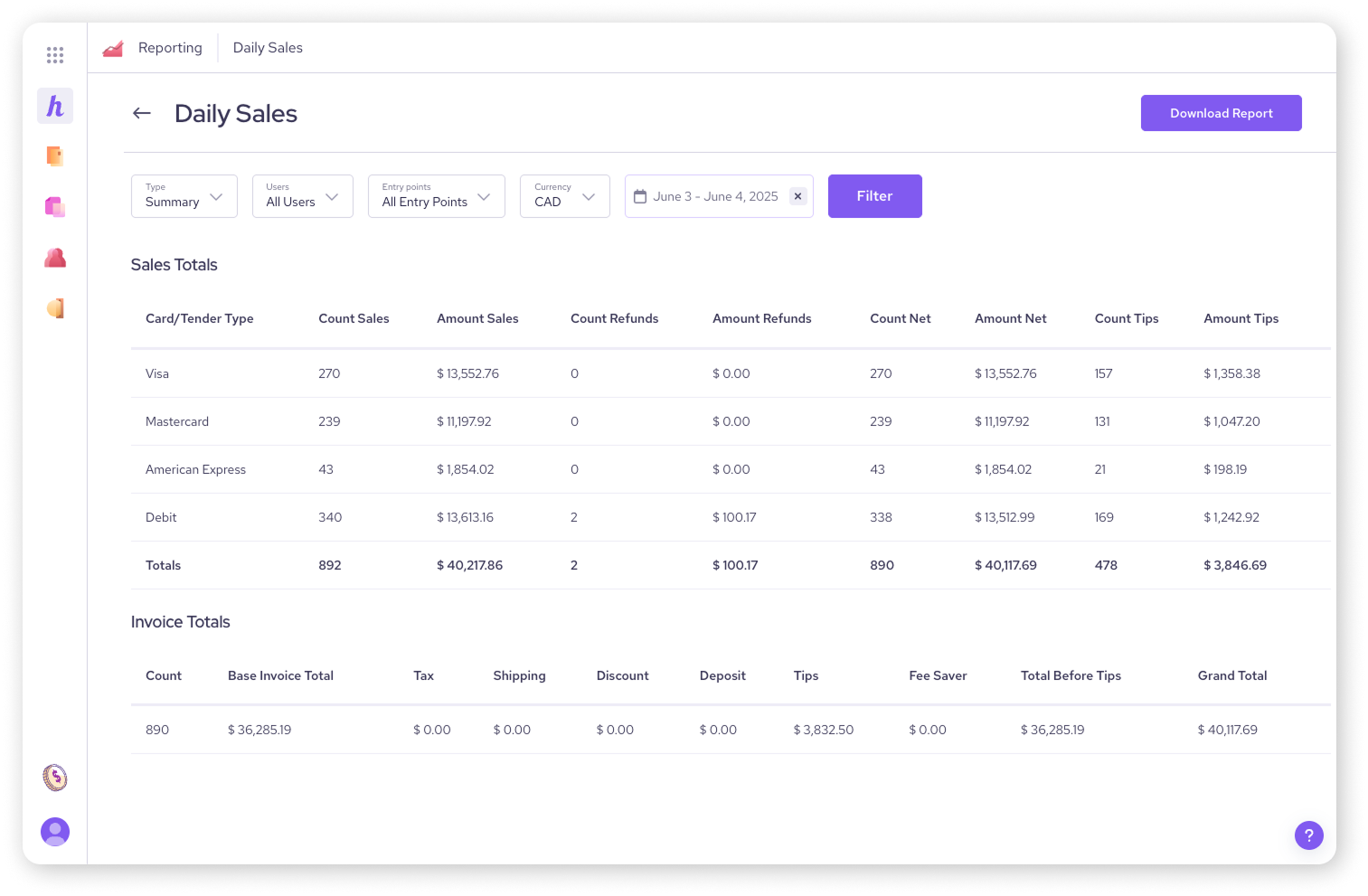

The ‘Daily Sales’ report offers a comprehensive overview of your sales, refunds, and transaction types for a specified period. You can choose between a Summary or Detailed view.

Summary report includes:

Sales totals

Sales by category

Invoice totals

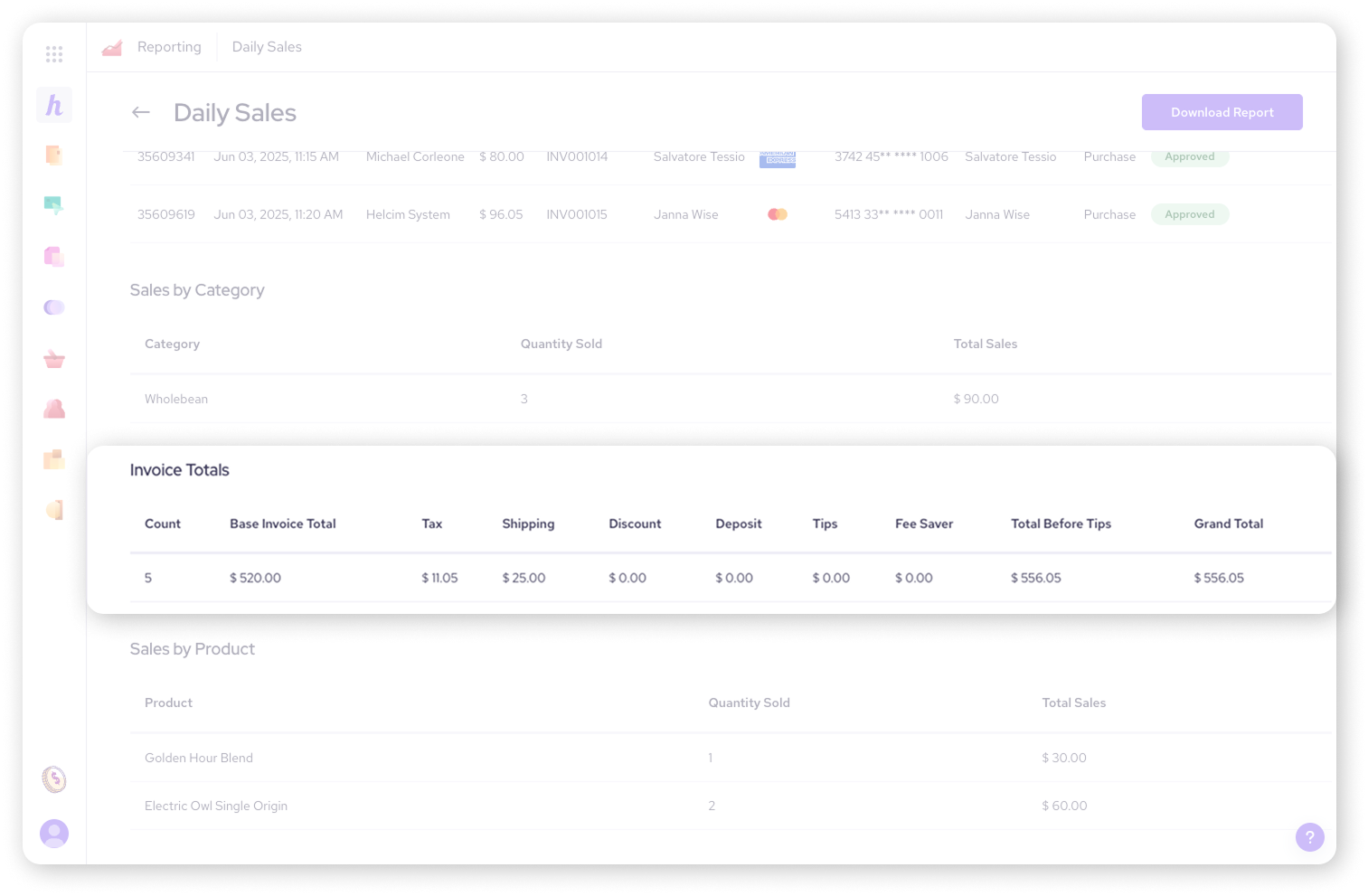

Detailed report includes:

Sales totals

A detailed list of credit card transactions

A detailed list of ACH/EFT bank payment transactions

Other tender transactions

Sales by category

Invoice totals

Sales by product

Discount codes used (if applicable)

Filters for the daily sales report

When generating your daily sales report, you can refine the data using specific filters:

Type: Choose Summary or Detailed using the report dropdown menu.

Users: Select All Users or a specific user to view transactions processed by them.

Entry points: Filter by the specific payment tool used to process sales using the dropdown menu.

Currency: Select the currency of the transactions you wish to view.

Date Range: Essential for defining the reporting period.

| Remember to click Filter again to refresh the report and apply filters. |

Key report information and definitions

To accurately interpret your daily sales report, it's important to understand these terms:

| The date filter for this report refers to the date that transactions occurred. Invoice dates are not considered in the report construction. |

Sales totals: This section is a breakdown by Tender Type of the sales and refunds that occurred during the specified report time period.

Amount sales: The sum of sales made (Includes purchases, captures, withdraws, and any other tender transaction) minus the sum of refunds for those transactions. Voided transactions are not included in this calculation.

Amount refunds: The sum of all transaction amounts that were refunded. Voided transactions are not included in this calculation.

Amount tips: The sum of all tips collected.

Credit card transactions: Comprehensive list of all credit and debit card transactions processed through our system during the specified report time period.

ACH/EFT transactions: Comprehensive list of all ACH/EFT Bank Payments processed through our system during the specified report time period.

Other tender transactions: Comprehensive list of all ‘Other Tender’ transactions (cash, cheque, etc.) processed through our system during the specified report time period.

Invoice totals: The Invoice Totals sections includes the sum of all Paid amounts on invoices per the transaction dates. (See the section below for more details.)

Invoice totals breakdown

The 'Invoice Totals' section of the daily sales report provides a detailed summary of an invoice's financial components once it is included in the report:

Base invoice amount: Sum of all Paid amounts at the subtotal level of an invoice.

Tax total: The sum of invoice Tax amounts.

Shipping total: The sum of invoice Shipping amounts.

Discount total: The sum of invoice Discount amounts.

Deposit total: The sum of invoice Deposit amounts.

Tips total: The sum of invoice Tip amounts.

Fee Saver: The Fee Saver amount paid by Customers via Online and In Person Fee Saver.

Total before tips: The sum of all invoice fields prior to tip amounts.

Grand total: The sum of the total amounts paid on the invoices.

Discrepancies between sales and invoice totals

You might notice differences between the Sales Totals and Invoice Totals sections in your daily sales report. This can happen when transaction and invoice processing aren't perfectly aligned.

| For example, when an Other Tender Transaction is initiated from the Payments Section > New Payment > Take Other Tender Payment, it will not create an associated invoice, leading to a discrepancy. |

Invoices are included in the Invoice Totals section where the invoice status is set as Paid, or Due with a partial payment.

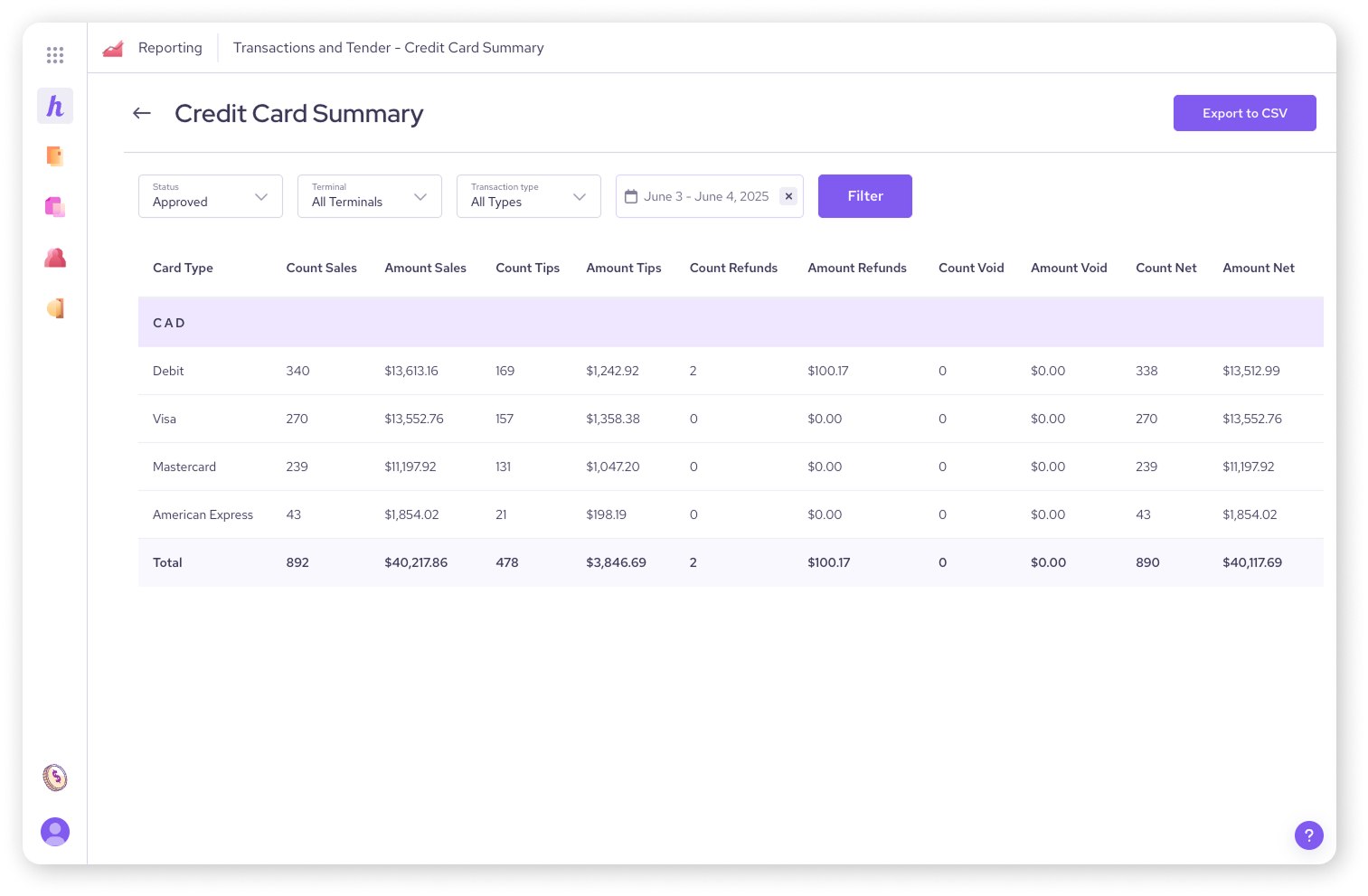

Credit card summary report

The ‘Credit Card Summary’ report provides a high-level overview of your credit card transactions, categorized by card type (Debit, Visa, Mastercard, American Express). It summarizes key metrics for each card type.

Report columns include:

Card type: The type of credit or debit card used (e.g. Visa, Mastercard, American Express, Debit).

Amount sales: The total value of sales processed for that card type.

Count sales: The total number of sales transactions for that card type.

Count tips: The total number of tip amounts collected for that card type.

Amount tips: The total monetary value of tips collected for that card type.

Count refunds: The total number of refund transactions for that card type.

Amount refunds: The total monetary value of refunds issued for that card type.

Count void: The total number of voided transactions for that card type.

Amount void: The total monetary value of voided transactions for that card type.

Count net: The total number of sales minus refunds for that card type.

Amount net: The total monetary value of sales minus refunds for that card type.

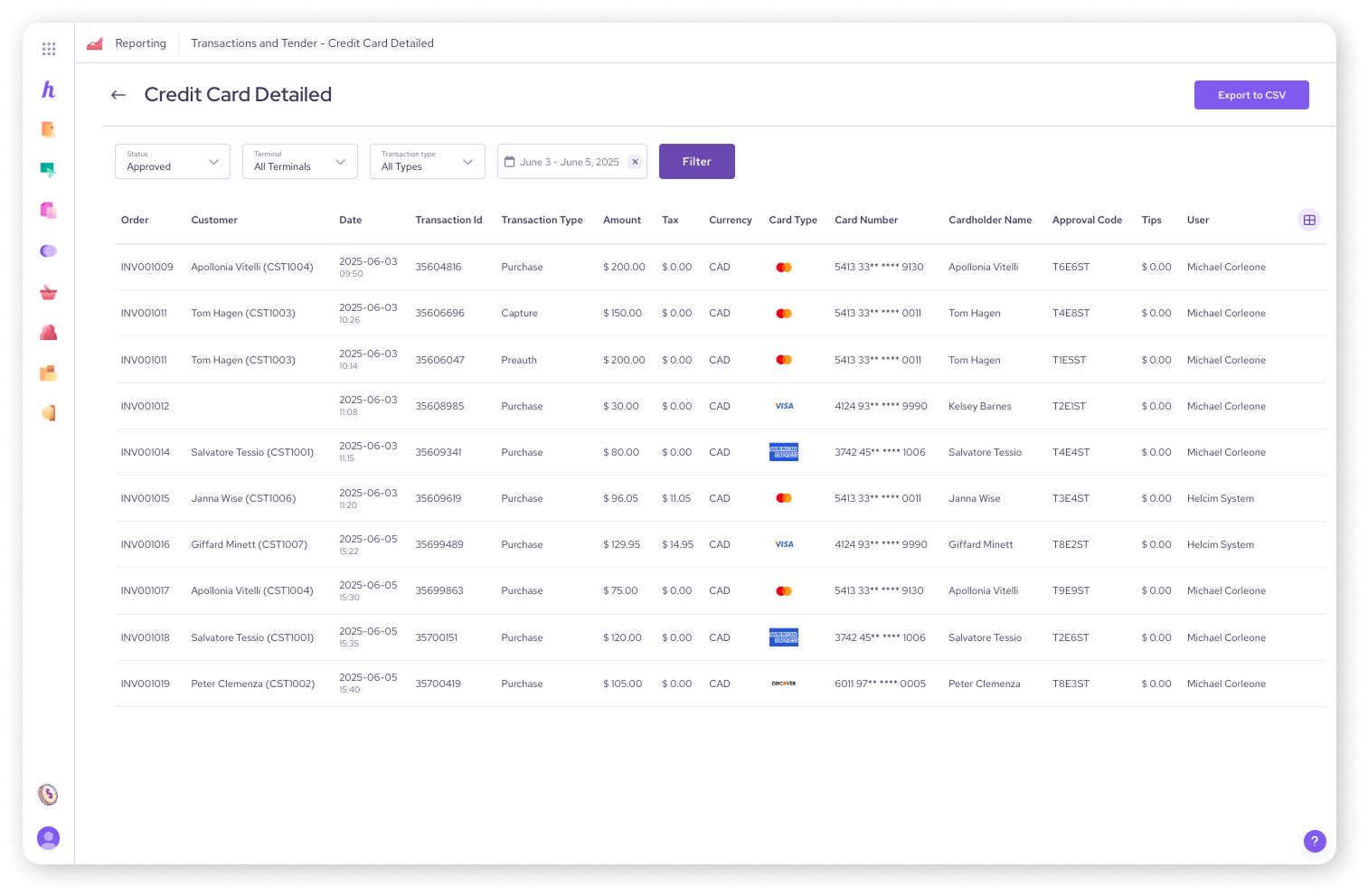

Credit card detailed report

For a deeper dive into individual credit card transactions, the 'Credit Card Detailed' report provides granular information for each payment.

Report columns include:

Order: The order number associated with the transaction.

Customer: The customer's name associated with the transaction.

Date: The date and time the transaction occurred.

Transaction ID: The unique identification number for the transaction.

Transaction type: The nature of the transaction (e.g. Purchase, Capture, Refund, Reverse).

Amount: The monetary value of the transaction.

Tax: The amount of tax applied to the transaction.

Currency: The currency in which the transaction was processed.

Card type: The type of card used for the transaction (e.g. Visa, Mastercard).

Card number: The masked card number for security (e.g. ****1234).

Cardholder name: The name of the cardholder.

Approval code: The unique code indicating the transaction was approved.

Tips: Any tip amount included in the transaction.

User: The Helcim user who processed the transaction.

Credit card report filters

Both the credit card summary and credit card detailed reports offer useful filters to narrow down your transaction data:

Status: Filter by Approved or Declined transactions.

Terminal: If you use multiple payment terminals, you can filter to see transactions from All Terminals or a specific one.

Transaction type: View All Types or specific types like Purchase, Capture, Refund, or Reverse.

Date Range: Essential for defining the reporting period.

Next steps

To gain even more specific insights into your business, explore reports related to your products and inventory, or delve into your invoice and tax data.

FAQs

Why are voided transactions not included in sales totals?

Voided transactions are cancelled and therefore do not represent actual sales or refunds.

How can I filter the daily sales report?

You can filter by Summary or Detailed view, All Users or specific users, Entry Point, Currency, and Date Range.

Can I see specific customer names in the credit card reports?

The credit card detailed report includes a Customer column to help you identify transactions.